CPI preview: Significant chance that core CPI sets a new high, burying hopes of a near-term Fed pivot

Key points:

Despite continued falls in gasoline prices, YoY headline inflation is likely to remain at high levels in September on account of a relatively low prior year comparable.

Core CPI, which is heavily exposed to lagging/smoothed rental data, has a significant likelihood of recording a new YoY peak in September for the current high inflation cycle.

The combination of these factors is likely to bury any market hope of a near-term Fed pivot.

The current inflation is marked by widely different price changes within key categories

In previewing the US’ upcoming September Consumer Price Index (CPI) report, it is critical to first note that the US’ current high inflation has been marked by widely different price changes amongst different CPI categories.

A key driver of this has been the nature of the COVID pandemic, and its associated lockdowns and movement restrictions. This meant that the surge in demand from stimulus measures and the associated increase in the money supply, was extremely heavily concentrated on durable goods, which were thus the first to see price rises.

As the economy began to re-open and movement returned to normal, commodities like oil began to rise. Nondurables prices were thus the second cab off the rank. Finally, as the economy fully re-opened, services prices began to rise. The lagging nature of rental measurement in the CPI also ensured that services were the last category to see an increase in prices (Figure 1).

This is a phenomenon that contrasts with previous periods of high inflation, where the indexes tended to move in closer unison (Figure 2).

Picking the CPI apart one piece at a time

Given the divergence in price changes between categories, in order to properly understand and analyse inflation and its outlook, we need to break down the overall CPI into its key categories, and look at the intricacies of each, before bringing it all together to make overarching conclusions.

Durables prices have decelerated sharply, but a negative comparable means the YoY rate is likely to move higher in September

Helped by a flatlining in M2 (Figure 3), which has resulted in real demand being gradually eroded by higher prices, durables price growth has decelerated sharply after peaking at a YoY rate of 18.7% in February (Figure 4).

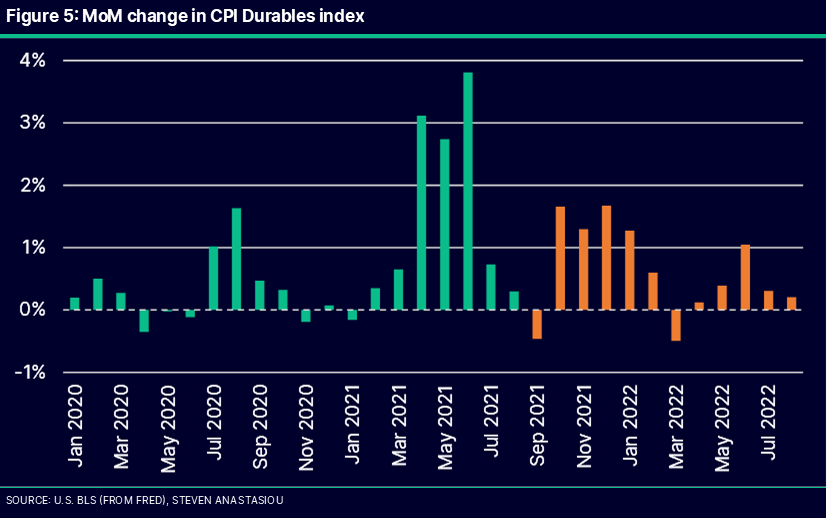

The annualised pace of durables price growth over the past 6 months has fallen to 3.2% and continues to move closer towards historical norms. Whilst there is a clear downward trend in durables prices, if durables price growth in September remains at the average rate seen over the past 6-months, the YoY rate would jump to 8.6% in September due to the negative prior year comparable (Figure 5). Though this is likely to quickly reverse back to deceleration, with YoY durables price growth likely to fall well below 4% by January 2023 as higher comparables are cycled from October to January.

Continued decline in gasoline prices to provide another month of support to decelerating nondurables prices

After the nondurables category (and the CPI as a whole) saw declines in July and August on account of falling gasoline prices, another decline in gasoline prices in September is going to provide further support for a continued alleviation of nondurables prices. According to weekly U.S. EIA data, the average monthly price of regular all formulations gasoline fell by 6.9% in September, after recording declines of 12.8% in August and 7.5% in July (Figure 6).

This has seen the YoY growth rate of monthly average gasoline prices slow dramatically from 60.9% in June to 16.5% in September (Figure 7).

At September’s prices, the YoY growth rate would turn NEGATIVE by March. This is what people need to also understand – that in order to have ongoing high inflation, prices need to continually keep rising. If they rise on account of a surge in the money supply, but the money supply then stays stagnant and prices simply remain at their new higher level, then inflation will fall and flatline over time.

The other critical component of the nondurables category, being food, has not seen price declines, with the YoY growth rate hitting a new high of 11.4% in August (Figure 8).

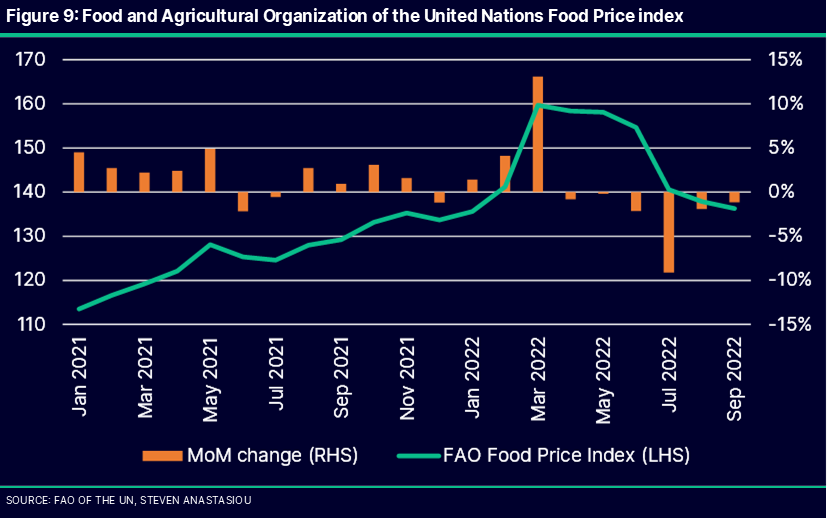

Though it is important to note that there are also signs of a reduction in food price pressures, with the United Nations’ FAO Food Price Index declining 1.2% MoM in September, making it the 6th consecutive month of decline (Figure 9).

This has seen the YoY growth rate fall from 34.0% in March to 5.5% in September. If continued, declines in primary food commodities over recent months would be expected to support reduced price pressure for food items in the CPI over coming months. With August representing the first month since December 2021 that food prices did not grow by a MoM rate of 1.0% or more on a rounded basis, whether a further MoM deceleration is seen in September will be worth paying close attention to (Figure 10).

Ultimately the nondurables category remains highly volatile and extremely difficult to predict on account of the ongoing impact of the Russia-Ukraine war, Western sanctions on Russia, future OPEC+ policy decisions, and the outlook for future US strategic petroleum reserve releases.

Services price pressure remains locked in due to lagging CPI rental indexes

With rent of shelter comprising more than half of the services index, and the CPI’s rental indexes significantly lagging actual spot market changes in rents, shelter costs are likely to contribute to ongoing price pressures for many months to come.

The extent of the catch-up required by the CPI’s rental indexes is significant, with the average of the Apartment List and Zillow rent indexes 13.7% higher than the CPI’s owners’ equivalent rent of residences index using a January 2019 baseline (Figure 11).

While flatlining M2 has contributed to a sharp deceleration in rental price growth (including a negative MoM rental change in Apartment List’s September update), which will help to converge the CPI and market indexes more quickly, the large gap between the CPI and spot market based indexes is likely to mean that the CPI’s rental indexes continue to record growth around their recent MoM levels of 0.5-0.8% for many months to come. This will put significant pressure on the overall CPI services category to continue growing at rates that are not too dissimilar from its current 6-month average of 0.7%.

Though it is worth noting that the last two months of services price growth have seen somewhat lower monthly increases of 0.4% and 0.6% respectively, as services prices outside of shelter saw a moderation of growth rates (Figure 12). This is not surprising given an ongoing flatlining of M2. If this continues it would mark another key factor driving decelerating price pressures, and it thus forms another important data point to watch in tomorrow’s data release.

What this means for headline and core CPI

Looking at things in aggregate terms, while continued declines in gasoline prices will again provide support for another low MoM CPI number, a relatively low prior year comparable will mean that even if another overall MoM decline is recorded, the YoY rate will remain high (Figure 13).A flatlining in prices in September (market consensus is for a 0.2% gain) would result in the YoY rate declining only modestly from 8.3% to 8.0%. This has been a key point that individuals should have been, and need to be cognisant of. For this phenomenon was a factor in August too, where a low prior year comparable meant that despite a MoM decline in the CPI, the YoY rate remained high at 8.3%. This same phenomenon will again present itself in December. While I remain of the view that the headline CPI likely peaked in June (assuming that there is not another drastic surge in energy prices), it is thus nevertheless likely to remain significantly elevated through the end of 2022.

Turning our attention to the core CPI, where there is no MoM benefit from declining gasoline prices, and where locked in rental price growth receives a higher weighting, the outlook remains precarious.

Whilst I believe the core CPI is a rather poor measure of inflation due to its huge weighting to shelther costs, and particularly so given that shelter costs in the CPI are measured in a way that makes them a poor indicator of inflation, it nevertheless holds significant weight with the Fed, who believe that it provides a good picture of underlying price changes. Personal opinions aside, we must nevertheless dedicate significant attention to its outlook.

As opposed to the headline CPI, where I continue to believe that YoY price growth is likely to have peaked, there is a significant likelihood that the core CPI records a new YoY peak, and that it does so in the September CPI report. A MoM increase of 0.3% or more would see the core CPI set a new YoY record (on a two decimal place basis) in the current high inflation cycle. This compares to the compound monthly growth rate of 0.5% over the past six-months, which was also the MoM growth rate recorded in August. Market expectations are for a 0.5% MoM increase, which is also expected by the Cleveland Fed in its Inflation Nowcast. A MoM increase of 0.5% in September would see the YoY core CPI reach 6.7% versus its previous peak of 6.5% in March 2022.

A flatlining in prices in September (market consensus is for a 0.2% gain) would result in the YoY rate declining only modestly from 8.3% to 8.0%. This has been a key point that individuals should have been, and need to be cognisant of. For this phenomenon was a factor in August too, where a low prior year comparable meant that despite a MoM decline in the CPI, the YoY rate remained high at 8.3%. This same phenomenon will again present itself in December. While I remain of the view that the headline CPI likely peaked in June (assuming that there is not another drastic surge in energy prices), it is thus nevertheless likely to remain significantly elevated through the end of 2022.

Turning our attention to the core CPI, where there is no MoM benefit from declining gasoline prices, and where locked in rental price growth receives a higher weighting, the outlook remains precarious.

Whilst I believe the core CPI is a rather poor measure of inflation due to its huge weighting to shelter costs, and particularly so given that shelter costs in the CPI are measured in a way that makes them a poor indicator of inflation, it nevertheless holds significant weight with the Fed, who believe that it provides a good picture of underlying price changes. Personal opinions aside, we must nevertheless dedicate significant attention to its outlook.

As opposed to the headline CPI, where I continue to believe that YoY price growth is likely to have peaked, there is a significant likelihood that the core CPI records a new YoY peak, and that it does so in the September CPI report. A MoM increase of 0.3% or more would see the core CPI set a new YoY record (on a two decimal place basis) in the current high inflation cycle. This compares to the compound monthly growth rate of 0.5% over the past six-months, which was also the MoM growth rate recorded in August. Market expectations are for a 0.5% MoM increase, which is also expected by the Cleveland Fed in its Inflation Nowcast. A MoM increase of 0.5% in September would see the YoY core CPI reach 6.7% versus its previous peak of 6.5% in March 2022.

What this means for Fed policy: forget an imminent pivot

With the headline inflation rate set to remain high in September on account of a low prior year comparable, and the core CPI having a significant chance of setting a new record for the current high inflation cycle, it should be abundantly clear that now is not going to be the time that the Fed pivots. Instead, the release of this week’s inflation data is likely to further solidify market expectations for a 75bp hike (some may even again start proclaiming the need for a 100bp move).

Those who continue to expect an imminent Fed pivot instead have their heads in the sand, and are ignoring the message that the Fed has repeated time and time again, being that their priority is to reduce inflation. They know that this will bring pain, and they are willing to ignore it.

Whilst I would argue that they have already done the hard work on inflation by eliminating growth in M2, and instead of continuing to raise rates, all they need to do now is wait, if I invested on that premise I would not be successful. Instead of acting based on what the Fed should do, one needs to act based upon what the Fed will do. Given where inflation currently sits, and where it is is going to remain after the September CPI report (at high levels), the Fed is very likely to again aggressively raise rates at its next meeting. People need to stop dreaming of an imminent Fed pivot. The Fed put is no more. Act based upon reality and get your house in order – as things could get ugly.

Steven Iam still a little confused as to why consumer spending remains relatively high when you take into account the significant cost of living increases in recent times. If consumer spending was to reduce then surely inflation would stagnate. Not sure why consumer sentiment is still positive.

Victor Yovanche