May PCE Price Index Review: a significant move in the right direction

May's PCE Price Index data revealed a significant and widespread slowdown in MoM growth, with supercore PCE inflation returning to a YoY growth rate of 2% for the first time since February 2021.

In addition to this latest PCE Price Index (PCEPI) review, I intend to release a near-term update on the latest personal income and spending data. Following June’s CPI report, I intend to release an update to my medium-term US CPI forecast.

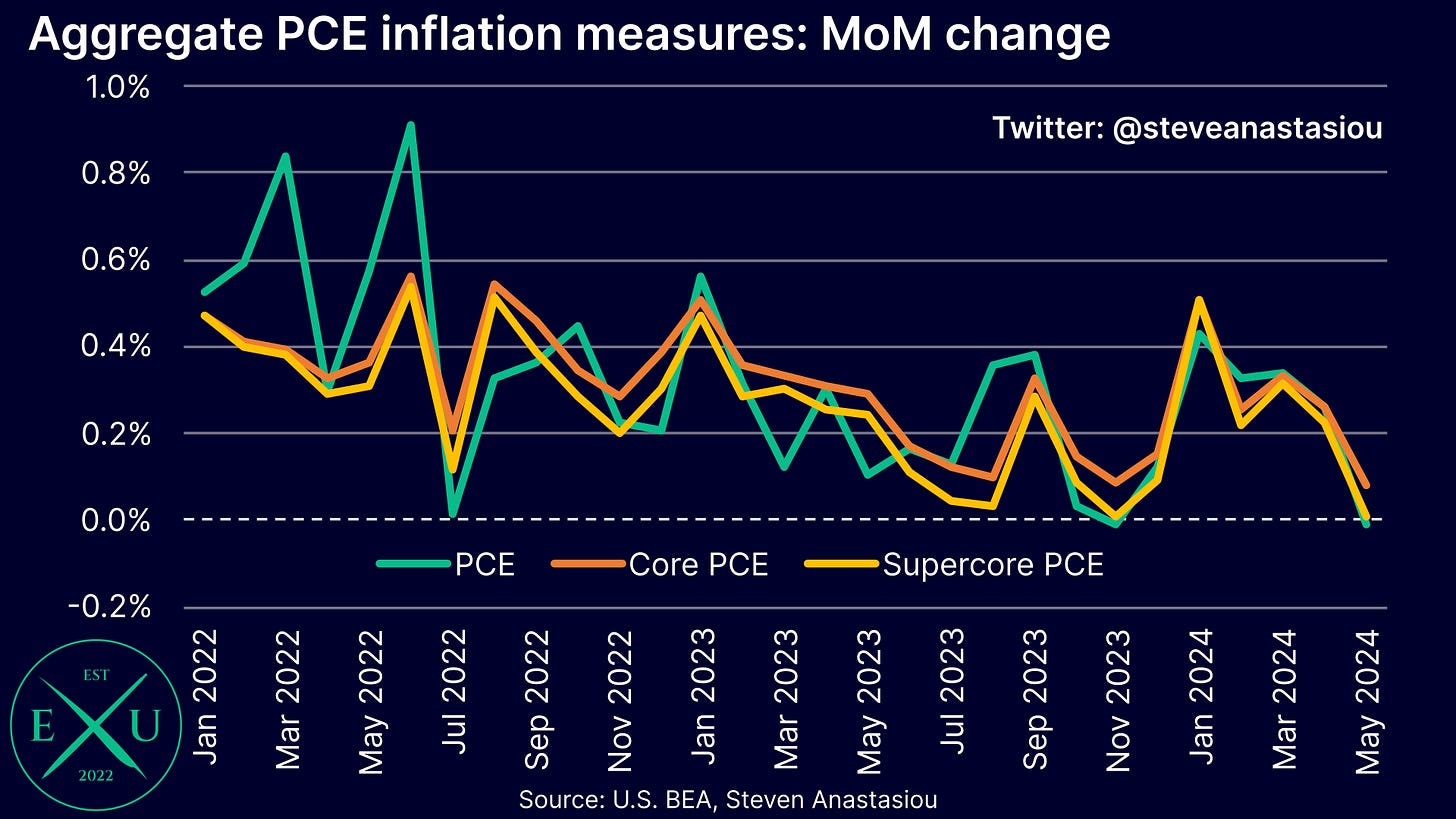

Following on from a much softer CPI report, the headline PCE Price Index (PCEPI) rose by -0.01% in May. This is the first MoM price decline that’s been seen since November.

The core PCEPI rose by just 0.08% MoM, its slowest rate of increase since November 2020.

Meanwhile the supercore PCEPI (i.e. the core PCEPI excluding the lagging housing category), recorded MoM growth of just 0.01%, the slowest pace of increase since November.

On a 3-month annualised basis, headline PCEPI growth fell to 2.4% (from 3.8%), core PCEPI growth fell to 2.7% (from 3.5%) and supercore PCEPI growth fell to 2.2% (from 3.1%).

After rising in the first few months of the year, the latest 3-month annualised data shows that price pressures have now normalised to a significant extent.

With January’s large MoM growth remaining within the 6-month annualised data, 6-month annualised headline PCEPI growth remained at 3.0%, core PCEPI growth remained at 3.2% and supercore PCEPI growth remained at 2.8%.

On a YoY basis, headline PCEPI growth fell to 2.6% (from 2.7%), core PCEPI growth fell to 2.6% (from 2.8%) and supercore PCEPI growth fell to 2.0% (from 2.2%).

Annual core PCEPI growth has now slowed to its lowest level since March 2021, while supercore PCEPI growth has fallen to its lowest level since February 2021.

Given that we know that housing inflation is likely to slow significantly on account of shifts in spot market rents (for a fuller explanation see my latest Medium-term US CPI update), with supercore PCEPI inflation now at 2% YoY, this points to a broadly positive outlook for the core PCEPI.