Latest PCE inflation data doesn't support another Fed rate hike

With the latest PCE inflation data showing deepening disinflation amidst falling lending growth and M2, any further increase in interest rates would unnecessarily add to the risk of a recession.

While headline PCE inflation rose on an annual basis in August (3.5% vs 3.4% in July), core PCE growth fell (3.9% vs 4.3% in July), with the increase in headline PCE inflation driven by higher gasoline prices.

On a “supercore” basis (which excludes lagging housing costs in addition to food & energy prices), PCE inflation saw 3-month annualised growth fall to just 1.5% (from 2.1%), marking the slowest rate of growth that has been seen since November 2020.

Taken in totality, the latest PCE inflation data provided a significant further indication that disinflation is deepening, and that now is not the time for additional interest rate hikes.

Let’s now take a closer look at the data.

Monthly movement

Headline PCE inflation saw higher growth in August (up 0.4% MoM), but this was largely driven by a jump in the gasoline and other energy goods category (up 10.2% MoM).

It’s important to note that despite the increase in oil prices, RBOB gasoline prices have fallen significantly in recent weeks. As a result, regular average gasoline prices are now below their August average.

The increase in gasoline prices drove an increase in overall nondurable goods prices in August (up 1.4% MoM). In contrast, durable goods prices saw their third consecutive month of MoM deflation, with prices falling 0.3% in August.

Services prices saw a significant moderation in MoM growth in August, with growth falling to 0.2% (from 0.5% in July). This came despite another month of elevated growth in the PCE’s housing services category (up 0.4% MoM) and in-part reflects the non-repeating of the artificial MoM surge in imputed portfolio management costs in July.

Services prices excluding energy and housing, which is a key focus of the Fed, rose just 0.1% MoM, resulting in the lowest monthly growth that’s been seen since November 2020.

Recent price trends: 3-month annualised changes

On a 3-month annualised basis, the PCEPI (PCE Price Index) rose 3.1%, up from 2.0% in July. Though with its exclusion of gasoline prices, 3-month annualised growth in the core PCEPI fell to 2.2%. Once housing is excluded (which is based on lagging rental price data), supercore PCEPI growth fell to just 1.5% — the lowest rate of growth that’s been seen since November 2020.

In order to exclude the impact of volatile movements in imputed price categories (such as portfolio management), one should also look at market-based PCE inflation measures. Here, 3-month annualised growth rose to 2.7% (from 1.4%). Though once the rise in gasoline prices is excluded, growth fell to 1.5% (from 2.2%) on a core basis.

Breaking the 3-month annualised change down into its key components, we can see that durables prices have been strongly deflationary, and declined by an annualised rate of 5.4% in August — in data dating back to 1959, this is the largest decline on RECORD.

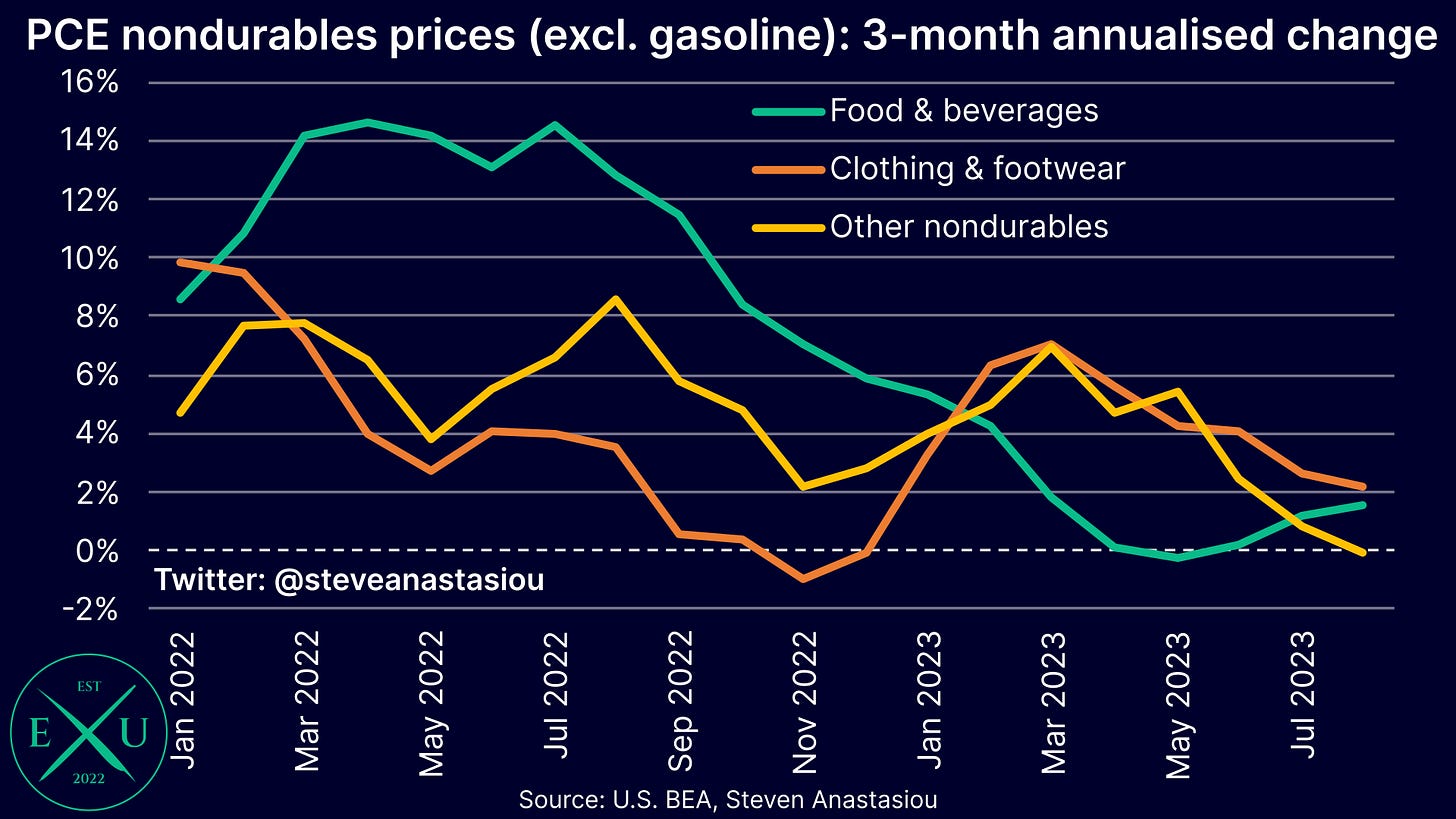

While 3-month annualised nondurables price growth increased to 5.9% in August, this has been driven by the surge in the gasoline and energy goods component (up 53.3%) — all other nondurables categories have recorded 3-month annualised growth of 2.2% or less.

Services prices, which are the most lagging, show a more mixed picture. The lagging housing category continues to record elevated growth (5.4%), but is gradually moderating. Health care prices continue to see modest growth (2.1%) and food services and accommodation prices have flatlined over the past 3 months.

The financial services & insurance component has jumped by an annualised 11.2% over the past 3 months, but this includes the impact of the huge jump in imputed portfolio management prices in July, which saw the portfolio management and investment advice services category rise 6.9% MoM in July. Somewhat smoothing out this increase by looking at price growth on a 6-month annualised basis, shows a more modest increase to 5.1%.

Recreation services prices have risen to 3-month annualised growth of 5.7%, but other services prices growth was just 1.8% in August, marking a major moderation over recent months.

Looking at services prices as a whole, 3-month annualised growth has remained elevated (3.9%), but has decelerated significantly from peak levels. Excluding energy and housing, services price growth has fallen to 3.4%, again representing a major decline from peak levels.

Longer-term price trends: 6-month annualised & YoY growth

In order to smooth out shorter-term volatility and identify longer-term trends, it’s also important to take a longer-term view of price changes — here we can see further evidence that PCE inflation is moderating.

On a 6-month annualised basis, headline PCE inflation was 2.6% in August, up slightly from 2.5% in July. Annual growth rose to 3.5%, from 3.4% in July. Both measures have moderated significantly over the past year.

Durable goods prices have been a strong contributor to moderating PCE inflation, with durables prices continuing to show outright deflation on both a 6-month annualised and YoY basis in August — indeed, the pace of the decline increased in August.

While still elevated, services prices also continued to deflate on both a 6-month annualised and YoY basis — a major gap has now opened up between the two, indicating that should more recent trends continue, annual services price growth is set to fall materially in the months ahead.

Services prices excluding energy and lagging housing costs, also continued to decelerate on a 6-month annualised and YoY basis — again, a major divergence has opened up between the two time periods.

With durables and services prices continuing to decelerate, the increase in PCEPI growth in August was driven by the nondurables component, with annual growth increasing from 0.2% in July, to 2.1% in August. Again, this was driven by gasoline and other energy goods — all other nondurables categories recorded broadly flat or decelerating 6-month average, and annual price growth in August.

The impact of this broad based decline in prices can be clearly seen in core PCE inflation, which fell to 3.0% on a 6-month annualised basis (from 3.4%) and 3.9% on an annual basis (from 4.3%). As with other categories, a gap has opened up that suggests lower YoY growth ahead, should more recent price trends persist.

Once housing, and the associated impact of lagging rents are taken out of the equation, annual growth in supercore PCE inflation fell to 3.2% (from 3.6%), while 6-month annualised growth fell to just 2.4% (from 2.8%).

6-month annualised market based PCE growth rose slightly in August to 2.3% (from 2.2%), while annual growth rose to 3.2% (from 3.0%).

Meanwhile, 6-month annualised growth in market-based core PCE inflation fell to 2.4% (from 2.8%) while annual growth fell to 3.6% (from 4.0%).

Latest PCE data provides further evidence that no additional rate hikes should be delivered

Looking at the latest data in totality, shows that disinflation is widespread, and is deepening. This is evidenced by:

durables prices being in outright YoY deflation (including the largest decline in 3-month annualised prices on record in August);

nondurables prices excluding volatile gasoline and other energy goods continuing to a moderation in YoY growth;

spot market rental data recording YoY declines (as per Apartment List), which is leading to a slow deceleration in PCE housing services price growth;

a major moderation in 6-month annualised and annual PCE services excluding energy and housing price growth;

Given these underlying trends, it’s no surprise that 3-month annualised “supercore” PCE inflation (excluding food, energy and housing) has decelerated to just 1.5% in August.

With 3-month annualised growth in market-based core PCE inflation saying the same thing, it’s clear that the disinflationary trend is not only widespread, but continues to grow.

While rising oil prices have the potential to impact near-term headline inflation, it’s important to note that the same increase has not flowed through to RBOB (wholesale) gasoline prices, which have fallen significantly in recent weeks. As a result, regular unleaded gasoline prices are now below their August average. Should the decline in RBOB gasoline prices hold, regular unleaded gasoline prices would appear set to move lower still in the near-term.

With QT continuing, and with significant declines in not only inflation, but commercial bank lending growth, bank deposits and the M2 money supply, key data points do not support a further increase in interest rates from the Fed, which would unnecessarily add to the risk of a recession.

Thank you for reading my latest research piece — I hope it provided you with significant value.

Should you have any questions, please feel free to leave them in the comments below!

In order to help support my independent economics research, please consider liking and sharing this post and spreading the word about Economics Uncovered. Your support is greatly appreciated and goes a long way to helping make Economics Uncovered a sustainable long-term venture that can continue to provide you with valuable economic insights for years to come.

If you haven’t already subscribed to Economics Uncovered, subscribe below so that you don’t miss an update.