Reviewing the latest PCE inflation, spending and personal income data

While the latest PCE inflation data was much more positive, some of the disinflation vs January was anomalous. While consumer spending bounced back, disposable income trends are sending a warning.

This latest research piece unpacks not just the PCE Price Index (PCEPI), but also delves into the latest Bureau of Economic Analysis (BEA) data on personal spending and income, before concluding with a summary of the related implications for Fed policy.

Let’s delve in.

MoM change: positive signs on services prices, but some of the decline was anomalous in nature

Key aggregates

Headline PCEPI growth came in at 0.33% MoM (4.1% annualised) in February, down slightly from January’s growth rate of 0.38% MoM.

Core PCEPI growth was 0.26% MoM (3.1% annualised), marking a significant deceleration from January’s growth rate of 0.45% MoM.

Supercore (defined for the purposes of this research report as the core PCEPI less the lagging housing component) PCEPI growth was 0.22% (2.7% annualised), also down materially from January, which saw growth of 0.44% MoM.

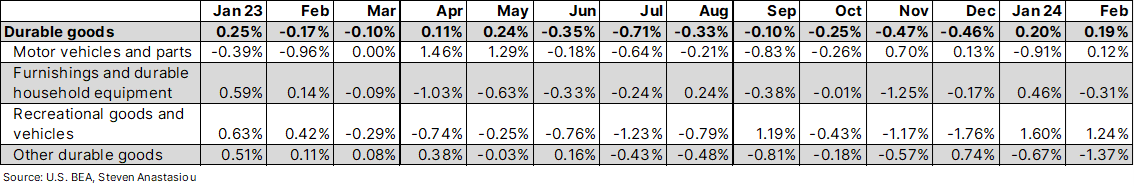

Durable goods

Breaking down the monthly change, durable goods prices rose for the second consecutive month. Growth was again driven by the recreational goods and vehicles subcomponent (up 1.2% MoM vs 1.6% in January). Each of the other durable goods categories recorded either modest or negative MoM growth.

Growth within the recreational goods and vehicles category was driven by computer software and accessories prices, which rose by 3.6% MoM. This follows a rise of 2.0% MoM in January. This very strong growth comes after three months of major price declines across October to December. Given that there hasn’t been a clear trend of significant price growth, this indicates that the recent jump in price growth may be being driven by larger than usual beginning of year price rises, as opposed to a more enduring trend.

Nondurable goods

Nondurable goods prices rose for the first time since September, with growth driven by a significant increase in the gasoline and other energy goods components (+3.4% MoM). The clothing and footwear category also saw a significant increase (0.96% MoM or 12.1% annualised), but this came after five consecutive MoM declines, including several very significant MoM price drops.

The overall increase in nondurable goods prices was 0.66% or 8.2% annualised. While this is a very significant MoM increase, it was primarily driven by volatile gasoline prices. The broader trend in nondurables prices (which will be discussed within the 3- and 6-month annualised change sections), remains unconcerning.

Services — many positive signs, but the full extent of the disinflation was driven by an anomaly

The big news in February, was the major deceleration in services price growth, which fell from 0.65% MoM or 8.0% annualised in January, to 0.26% or 3.1% annualised in February — though a deeper look at its key subcomponents reveals that some of the moderation was likely anomalous in nature.