The composition of loan growth bears watching

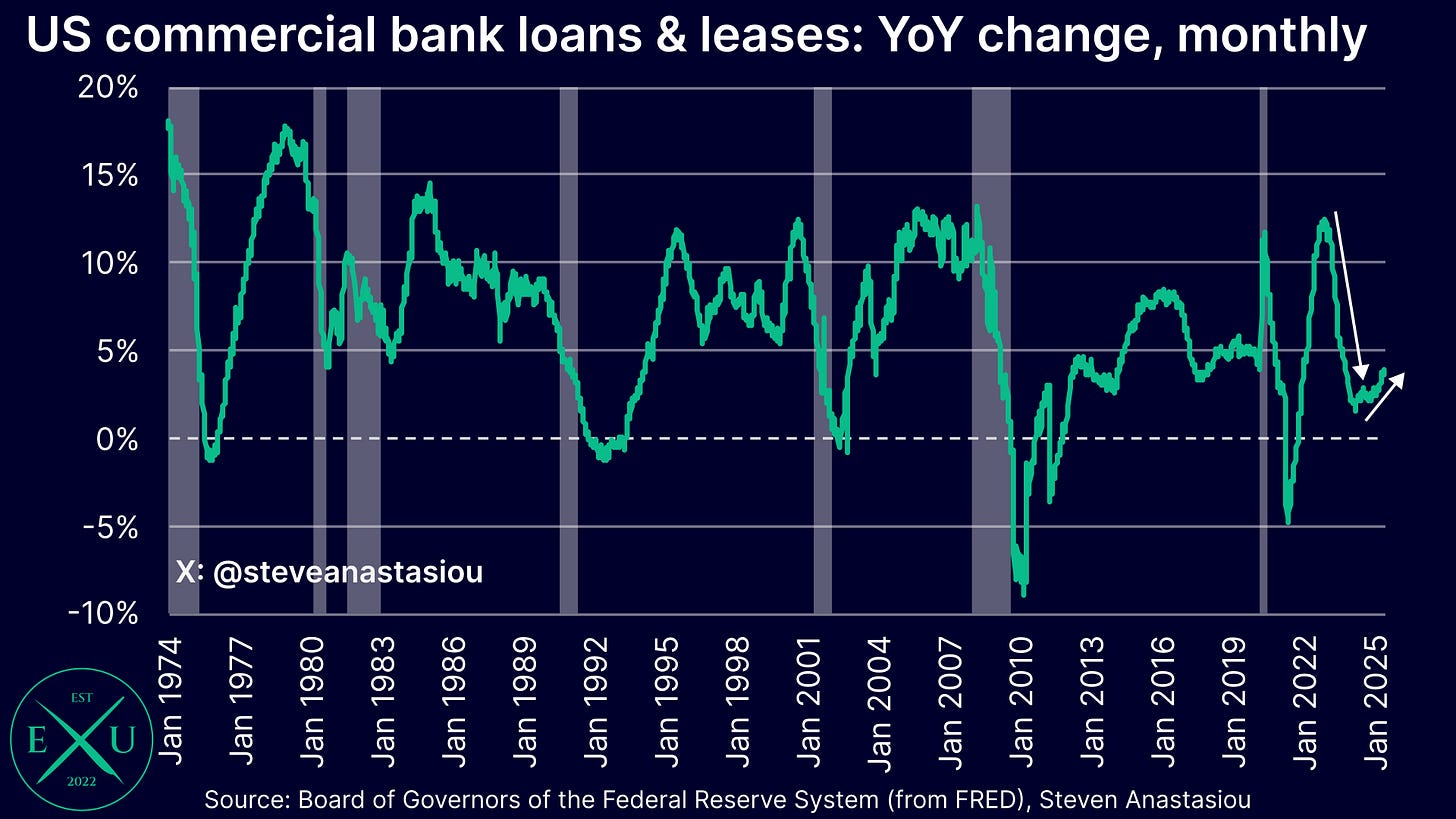

While there has been relatively little news of significant banking stress in recent quarters, a deeper look at commercial bank lending data reveals some concerns.

While concerns surrounding the Fed’s significant monetary policy tightening were exacerbated following the failure of Silicon Valley Bank and other regional banks in 2023, with not much in the way of significant banking issues arising since, and loan and lease growth quickening over the past year, banking sector worries have significantly dissipated.

Though a deeper look at the data shows that some concerning undercurrents have been building under the surface, with real estate and business lending growth slowing or remaining low, whilst other lending categories — some of which are riskier, more speculative and expensive — have been supporting or driving the growth in commercial bank lending.

Here’s four key points that you need to know:

1) Commercial real estate lending growth has evaporated

After sparking significant concern during the earlier phases of the interest rate hiking cycle, focus on the commercial real estate sector has seemingly dissipated in recent quarters – just as bank lending data suggests that it shouldn’t be.

For after a prolonged period of relatively high interest rates, commercial real estate lending growth has virtually all but evaporated, with YoY growth falling to just 0.8% as of 4 June. With overall loan volumes nearing a contraction, this indicates the potential for issues to arise over coming quarters if interest rates remain elevated. Not since 2012 has commercial real estate lending growth been YoY negative.

2) Residential real estate lending growth has fallen significantly

Not only has commercial real estate lending growth been significantly impacted by higher rates, but understandably, so too has residential real estate, with the value of outstanding loan growth falling from over 10% in February 2023, to just 2.0% YoY as of 4 June.

Though it is important to note that while having slowed significantly, 3-month annualised growth has risen since the beginning of the year, providing a sign that conditions have stabilised in recent months.

When taken as a whole, growth in commercial bank lending to the real estate sector has fallen to 1.3% YoY versus the 2015-19 average of 4.6%.

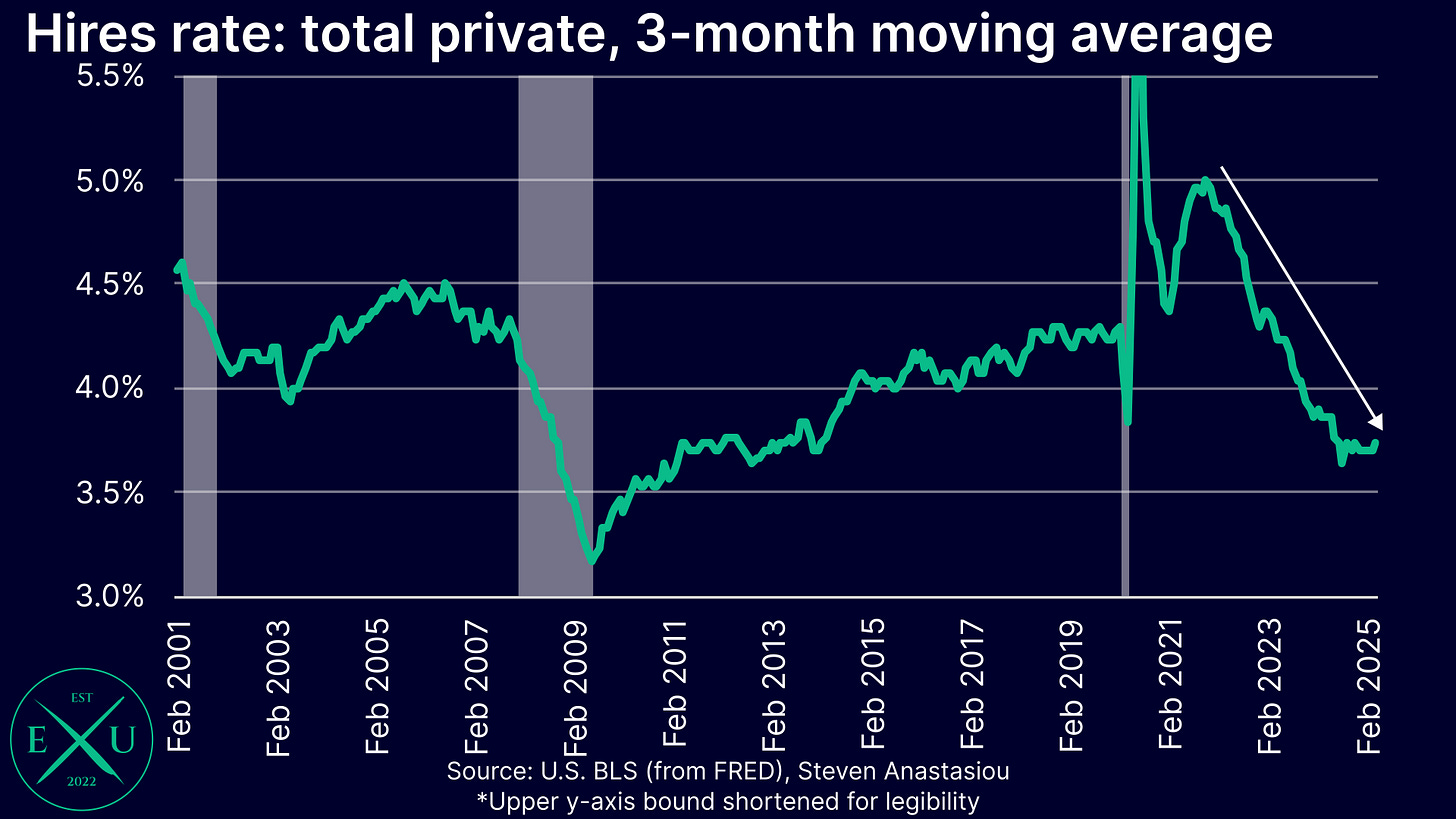

3) Business lending remains relatively slow

While commercial and industrial lending growth has returned to positive territory on a YoY basis, at just 2.2%, it’s well below the 2010-19 average of 5.6% YoY. While this could be partly due to businesses having a reduced need for borrowings in light of the relatively strong operating margins that have been seen in recent years, it could also be suggestive of muted investment intentions, which is corroborated by the major decline in the hires rate over the past several years.

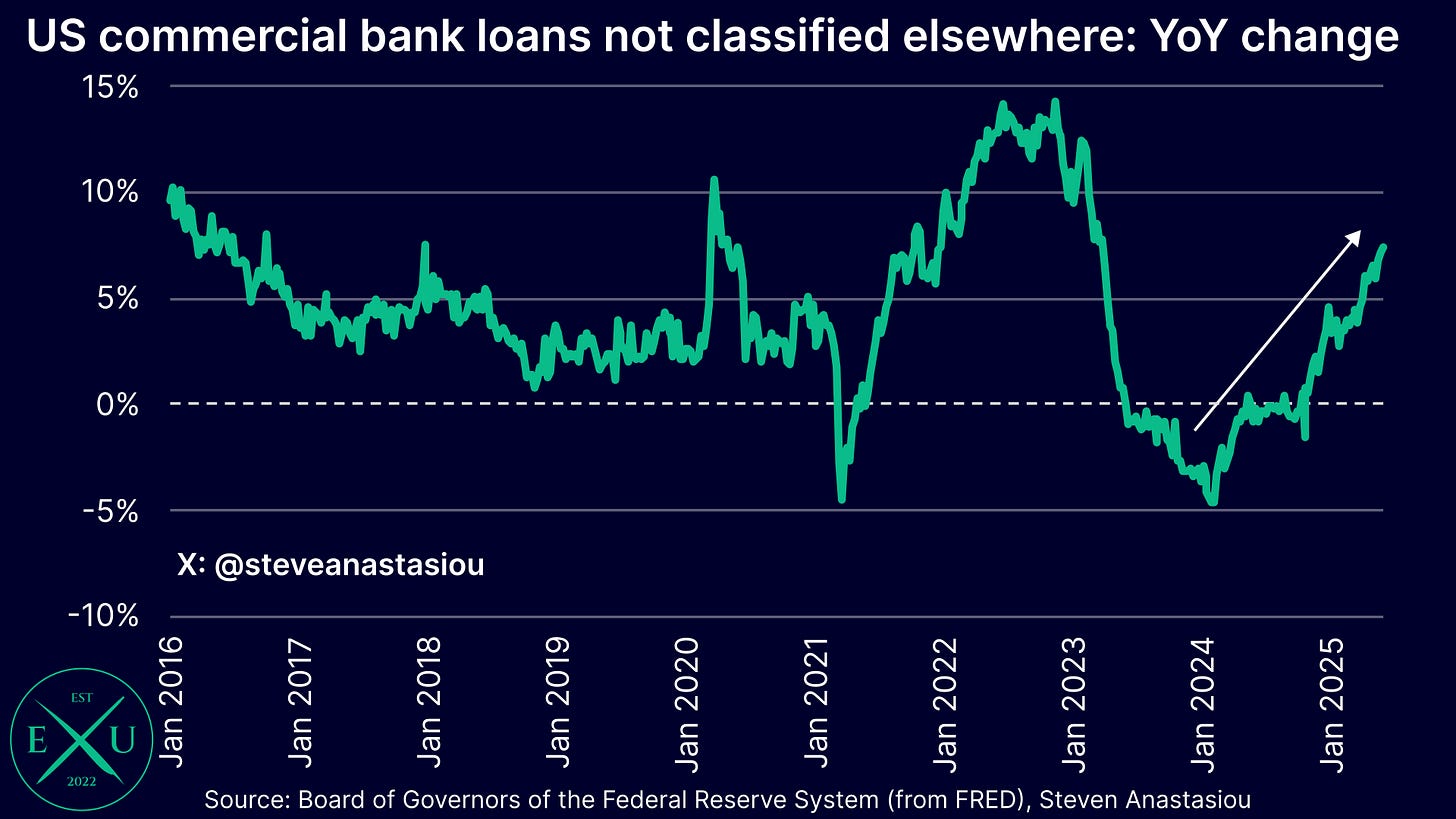

4) Riskier, more speculative and expensive lending categories drive the growth in bank lending

Commercial bank lending growth is instead being supported or driven by other loan categories, some of which are riskier, more speculative and expensive lending categories.

This includes credit cards and other revolving loans, which despite seeing growth fall from peak levels, continues to record notable YoY growth — 3.2% as of 4 June — while 6-month annualised growth remains above 4%.

Meanwhile, the “all other loans and leases” categories, some of which relate to riskier and more speculative lending areas, are recording very fast growth rates.

One of the two subcomponents within this grouping is the “loans to nondepository financial institutions” category, which has seen YoY growth surge to 19.9% YoY. This category includes loans to: real estate investment trusts; insurance companies; holding companies of other depository institutions; finance companies; mortgage finance companies; factors; federally-sponsored lending agencies; investment banks; banks’ own trust departments; and other nondepository financial intermediaries.

Finally, the “all loans not elsewhere classified” category has seen YoY growth rise to 7.3%. This category includes loans for: purchasing or carrying securities; loans to finance agricultural production; loans to foreign governments and foreign banks; obligations of states and political subdivisions; loans to nonbank depository institutions; unplanned overdrafts; loans not elsewhere classified; and lease financing receivables.

In summary …

While overall commercial bank lending growth has quickened over the past year, the underlying mix and trends within key loan categories is worth paying close attention to, with weakness in commercial bank business and real estate lending growth being propped up by credit card balances and the “all other loans and leases” categories, some of which relates to areas that are riskier and more speculative.

Given that interest rates continue to remain elevated, these underlying trends may worsen in the near-term. With previous areas of market concern such as the commercial real estate sector already showing that commercial bank lending growth has stalled, should interest rate relief not arrive in the months ahead, then the risk of a significant negative economic event may grow materially.

Are you an insitutional investor or business executive that would benefit from bespoke research, economic presentations or discussions? If so, please reach out to steven@economicsuncovered.com for a conversation on how Economics Uncovered can help you and your business.