The household survey is flashing a recession

While nonfarm payroll growth remained robust in February, plunging response rates and major negative revisions raise doubts about its accuracy. Meanwhile, the household survey is flashing a recession.

Economics Uncovered pays for itself

In the lead-up to the latest US jobs report, I released a US Jobs Report Preview.

Given that my economic analysis delves into the granular detail of US economic data, I have been pointing out that despite the positive headlines, US employment data actually contains many weak/outright recessionary data points.

Given that the consensus narrative continued to express a view that the US jobs market remains relatively strong, my US Jobs Report Preview clearly expressed that risks were skewed to the potential for a negative surprise:

“Despite these weak/recessionary indicators, given the general belief that the US jobs market remains in solid shape, consensus expectations are for nonfarm payroll growth of 200k in February, and for the unemployment rate to remain unchanged at 3.7%.

While the host of weak/recessionary employment indicators certainly doesn’t guarantee that February’s jobs report will reveal a significant weakening in nonfarm payroll growth, which may instead remain solid for several more months, given consensus expectations and the many weak/recessionary contradictions in the employment data, I believe that risks are firmly skewed to the potential for a significant negative surprise.”

US Jobs Report Preview: growing potential for a significant negative surprise

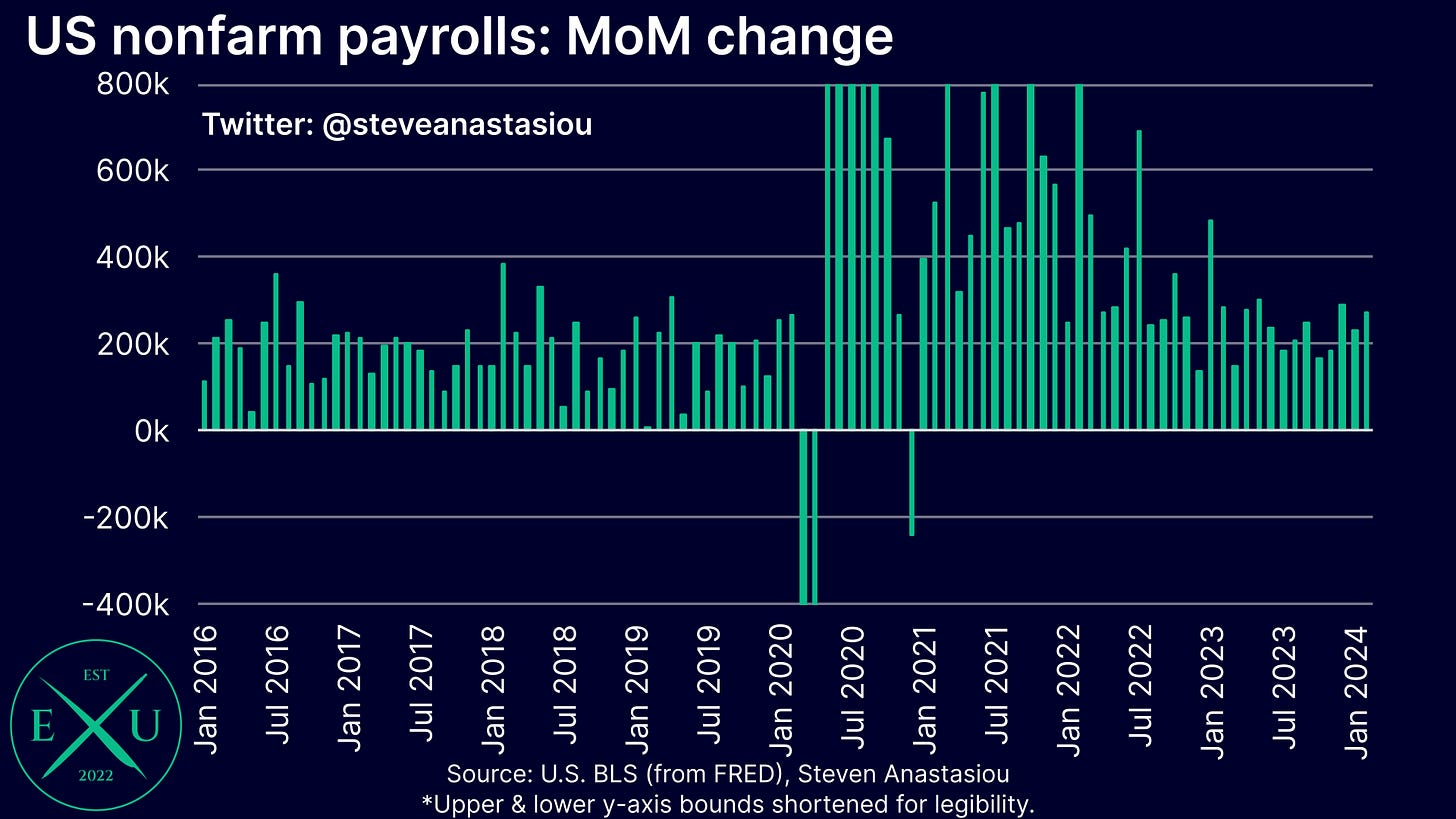

While headline nonfarm payroll growth was indeed relatively solid in February (275k versus 200k consensus), given that the now longstanding trend of significant negative revisions continued in February (-167k), the net job change was just 108k.

A key contradictory data point that I called out in my US Jobs Report Preview, being a major weakening in household employment growth, also continued in February, which led to the unemployment rate increasing to 3.9% — marking the highest unemployment rate seen since January 2022.

While another month of relatively solid headline nonfarm payroll growth prevented a major market shift, the latest jobs data was thus a net negative versus consensus expectations.

In response, the S&P 500 recorded a notable decline, 10Y bond yields continued to drift lower, and gold prices rose again, closing at a new all-time high — as the below excerpt shows, this combination was the very shift that I had articulated for premium subscribers in my US Jobs Report Preview.

While nobody can get it right every time, meaning that there will be times that I make a forecast or conduct an analysis that turns out to be wrong, by focusing on the areas that I understand well, and by conducting a comprehensive, data driven analysis, more often than not, I will hopefully get it right.

Whether by saving you time, by improving your own knowledge and understanding of key economic concepts, or by gaining an alternative insight that helps you to make better decisions, high quality economic analysis is an investment, not an expense.

By continuing to provide a comprehensive review of inflation, employment and broader measures of US and global economic activity, the benefits that can be derived from a premium subscription to Economics Uncovered, should not only cover the cost of your subscription, but exceed the cost many times over.

Digging into the latest employment data … with a slight twist

As alluded to above, the latest US jobs report continued its recent trend of relatively solid/strong headline nonfarm payroll growth, alongside a host of other weak/outright recessionary data points.

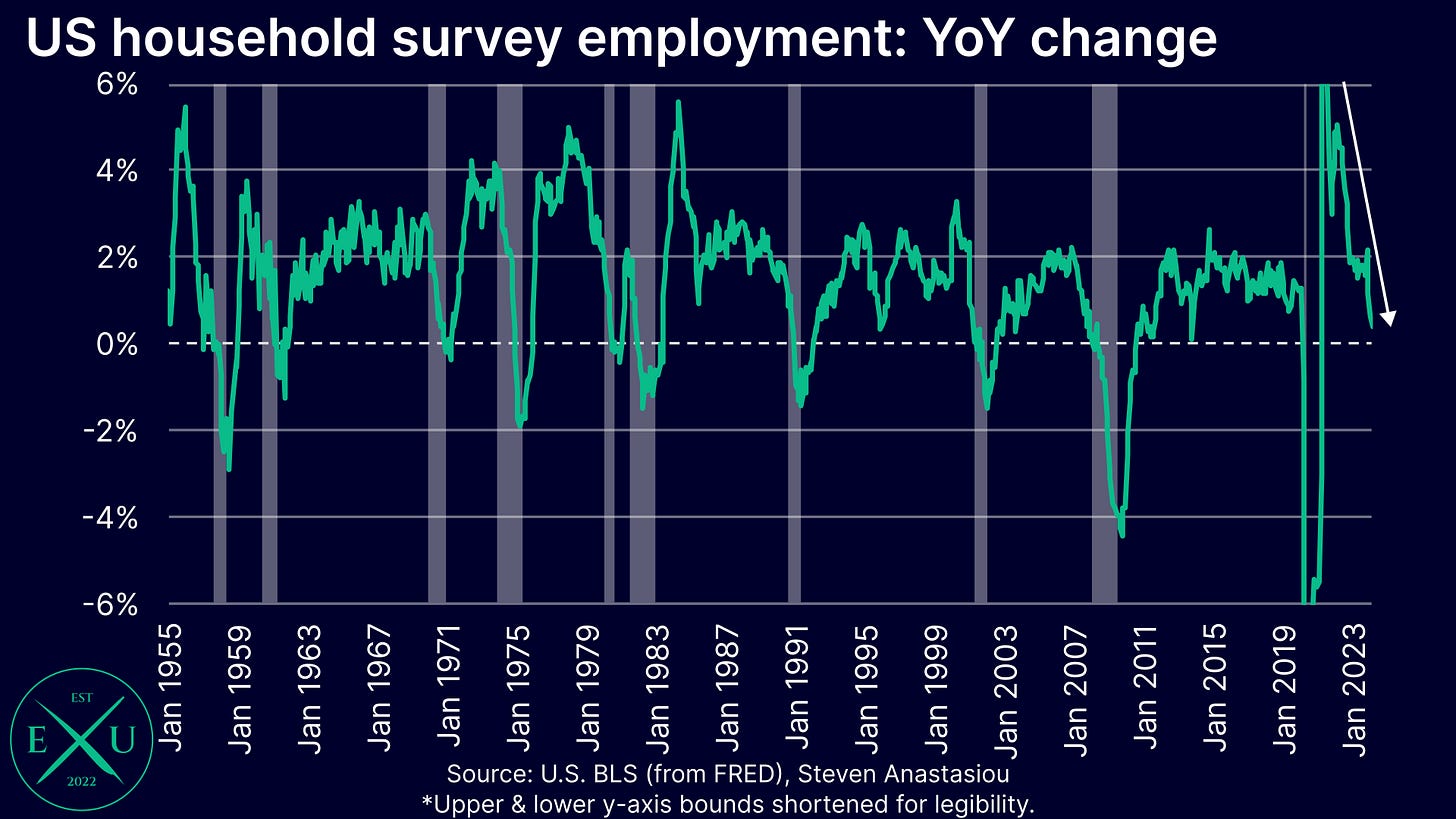

Chief amongst these concerns is the major weakening that’s been seen in the household survey, which in some respects, reflects an economy in recession.

While the Fed and markets have historically tended to focus on the establishment survey, a now longstanding trend of significant downward revisions to nonfarm payroll growth, alongside plunging establishment survey response and preliminary collection rates, raises significant concerns about the reliability of establishment survey data.

Given the multitude of other job market indicators that tend to support the weaker household survey data, and the historical tendency for economists, market analysts and the Fed to focus on nonfarm employment growth (which continues to point to a soft/no landing), this could be leading to a situation whereby the US economy is sleepwalking into a recession.

Given the significant economic ramifications of policymakers not attributing a significant focus to the many (often leading) weak/recessionary indicators that exist within the current US employment data, this is an analysis that you may want to reread several times in order to fully grasp.

In attempting to provide the most comprehensive and easily digestible analysis of the latest employment data, I have decided to adopt a slightly different format to this research report — please feel free to let me know if you found this to be a positive change!

In terms of the direct employment data analysis itself, I have broken it down into three sections: the good, the bad, and the ugly.

After providing this underlying detail, I will then provide an overall summary of the current state of the US employment market, followed by sections on: the implications for the Fed and the US economy; and the implications for financial markets.

Let’s begin with the good news on the employment!

Give me the good news first …

Both nonfarm payrolls and private payrolls continue to grow at a relatively strong/robust pace

Nonfarm payrolls grew at a relatively strong pace in February, rising by 275k. This marks the eighth month in the past twelve, that MoM growth was above 200k.

On a 3-month moving average basis, growth rose to 265k — the highest level since June.

While this unequivacably sounds like goods news, it’s important to note the ongoing trend of major downward nonfarm payroll revisions. This trend comes alongside material declines in response and initial collection rates, suggesting that the establishment survey may be suffering from significant nonresponse bias — this is explained alongside my analysis of the ongoing trend of significant negative payroll revisions within “the ugly” section of this report.

Private nonfarm payroll growth also rose in February, with MoM growth of 223k recorded.

This saw 3-month moving average growth rise above 200k for the first time since June 2023, marking a notable increase from the October trough of 148k, and a growth rate that is well above its pre-COVID level.

Though as noted above, it’s important to remember the trend of major downward revisions, which could see private nonfarm payroll growth revised materially lower over the months ahead.

The breadth of nonfarm payroll growth has improved

In addition to faster nonfarm payroll growth, the breadth of employment growth has improved in recent months, with a broader array of total private and manufacturing sector subcomponents, reporting an increase in employment.

Unemployment claims and layoffs both continue to remain relatively low

The bad

The unemployment rate has risen notably from its cycle trough

While still historically low, the unemployment rate rose to its highest level since January 2022 — at 3.9%, the unemployment rate is now 0.5 percentage points off its cycle trough.

Underemployment rates have risen even further

The U-6 unemployment rate, which measures underemployment, rose for a fourth consecutive month, hitting its highest level since December 2021. The U-6 unemployment rate is now 0.8 percentage points above its December 2022 trough.

Household survey employment growth has plunged, casting doubt on the relative strength of nonfarm payroll growth

Household survey employment growth has fallen to just 0.4% YoY — the lowest rate of growth seen since March 2021.

The major divergence between household and establishment survey employment thus widened significantly in February — the last time that a major divergence occurred, the gap was bridged via a decline in establishment survey employment growth.

Given the poor establishment survey response/initial collection rates, and its trend of major downward revisions, this suggests that once again, the establishment survey may be overstating the strength of the US jobs market.