US CPI Preview: July 2024

While July's CPI report is expected to provide another batch of further disinflationary evidence, hard-landing concerns could spike in the event that MoM growth surprises to the upside.

In addition to my YoY and MoM US CPI forecasts for July, this report contains an analysis of the implications for Fed policy and financial markets, as well as a detailed breakdown of some of the key categories that form my aggregated CPI forecasts.

YoY estimates & the disinflationary cycle

In July, I expect the headline CPI to record a fourth consecutive month of lower YoY growth, falling to 2.9% (2.94%) from 3.0% (2.97%). This compares to the consensus estimate of 2.9%.

I expect the core CPI to also record a fourth consecutive month of decelerating YoY growth, falling to 3.1% (3.14%) from 3.3% (3.27%). This compares to the consensus estimate of 3.2%. While my core CPI estimate is below the consensus estimate on a one-decimal place basis, it is not far away from rounding to 3.2%.

On an ex-shelter basis, I expect headline CPI growth of 1.8% YoY (from 1.8%). For the core CPI ex-shelter, I expect YoY growth to decelerate for a fourth consecutive month, falling to 1.7% (from 1.8%).

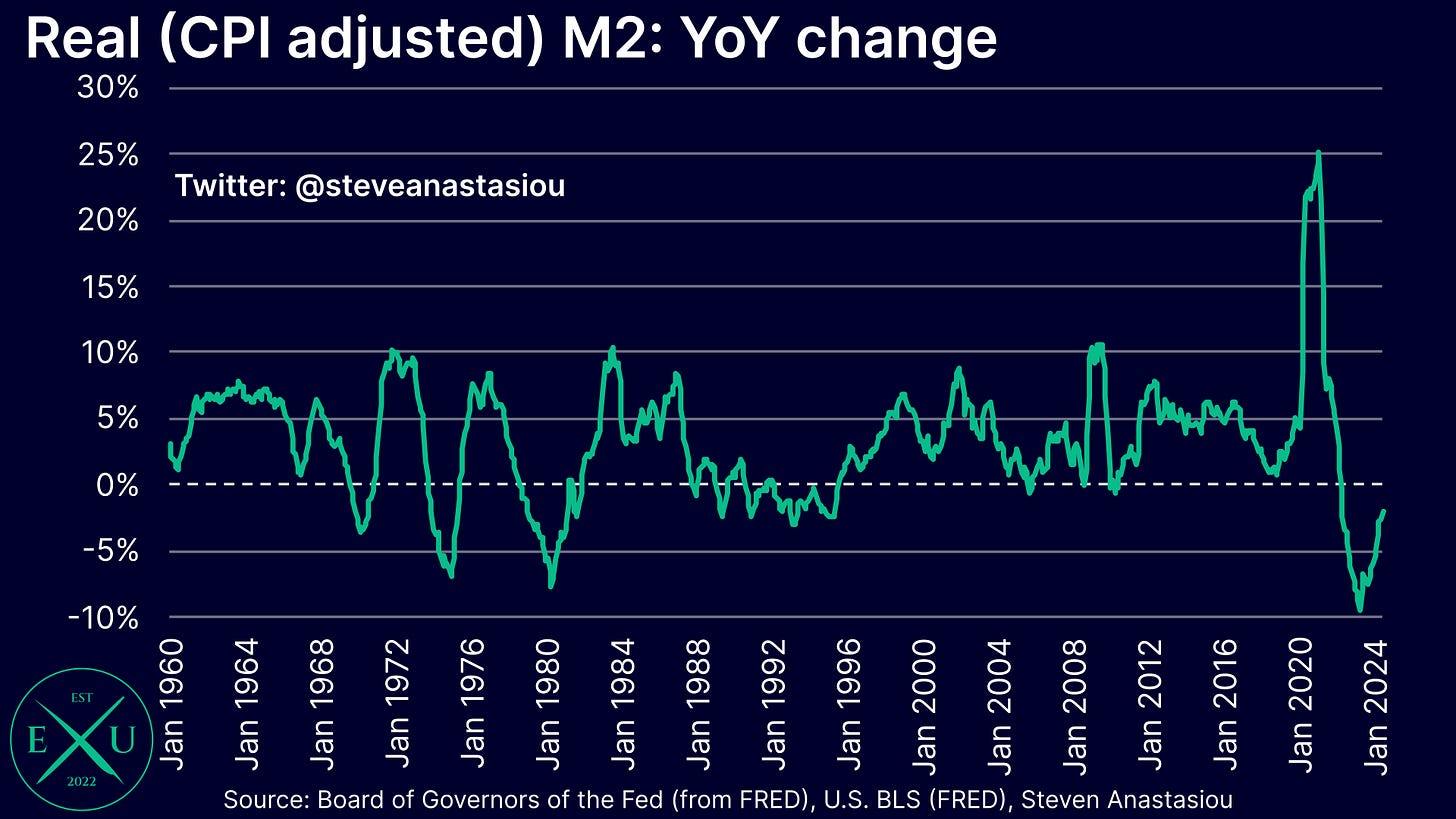

Disinflation continues to be supported by relatively modest growth in the M2 money supply, which on an inflation adjusted basis, recorded a 27th consecutive month of negative YoY growth.

With M2 growth having long ago decelerated, it’s no surprise to see that the disinflationary cycle has progressed significantly, with durables prices (the most responsive component to an increase in M2) deflating and nondurables prices disinflating significantly. Highlighting how the disinflationary cycle has strengthened and broadened, services prices — being the most lagging component of the price cycle — have recorded major MoM disinflation over the past two months (see the “Breaking down the details” section below for a breakdown of my services price forecasts for July).

This underlying understanding of the broader price cycle underpins my latest medium-term US CPI forecasts, where I expect further material disinflation to occur in 2H24 — my latest medium-term estimates and related analysis can be found, here.

MoM estimates

In terms of my monthly estimates — which better highlight the extent of the disinflation that has been seen over recent months — I forecast headline CPI growth of 0.17% versus the consensus estimate of 0.2%. This would result in 3-month annualised growth of just 0.48% (from 1.1%) and 6-month annualised growth of 2.5% (from 2.8%). This would represent the slowest pace of 3- and 6-month annualised growth since June 2020 and September 2020, respectively.