US CPI Preview: June 2024

While there's an elevated level of uncertainty over services prices in June, I nevertheless expect another month of relatively modest CPI growth, solidifying expectations for multiple 2H24 rate cuts.

Please note that I will be releasing an update to my medium-term US CPI forecast post the release of this month’s CPI data — stay tuned!

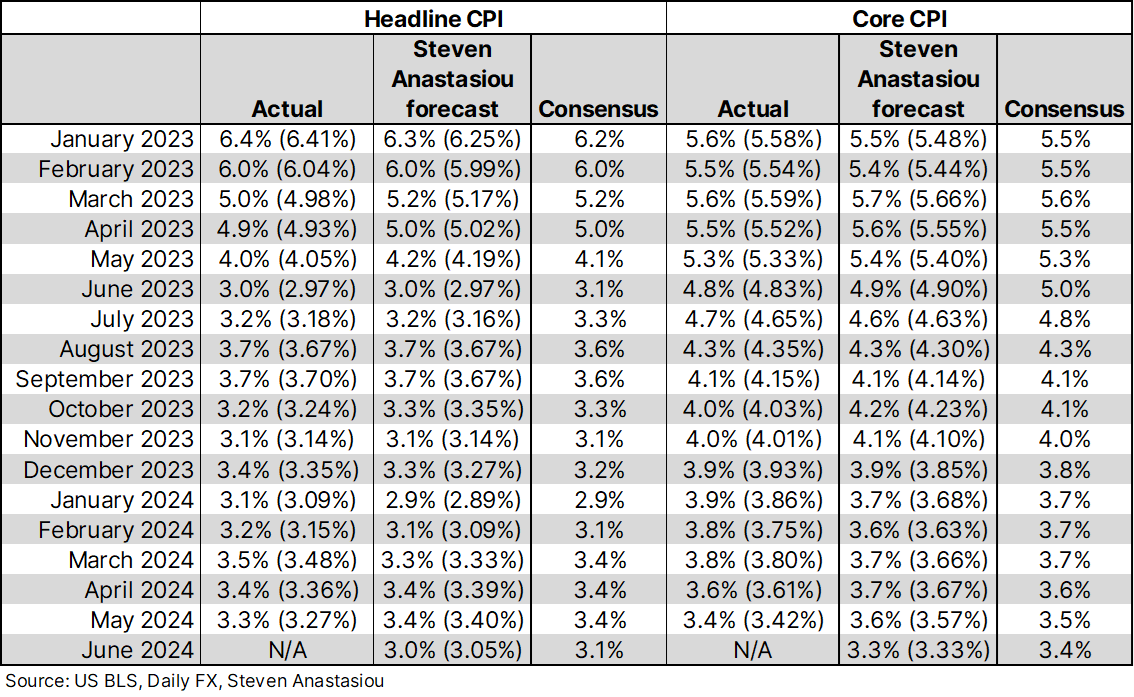

Headline and core CPI inflation forecast to come in below consensus estimates

I forecast headline CPI inflation of 3.05% YoY in June, down from 3.27% in May. On a one-decimal place basis my forecast rounds to 3.0%, which is below the consensus estimate of 3.1%.

For the core CPI, I expect YoY growth of 3.33% in June, down from 3.42% in May and below the consensus estimate of 3.4%.

As discussed within the “Breaking down the details” section of this report, the key uncertainties in regards to this month’s inflation data lie within the services category. An example of such an item is CPI motor vehicle insurance, which after a long stretch of very high MoM growth, saw a material MoM decline in May.

While I expect the medium-term direction of CPI motor vehicle insurance and services prices more broadly to be firmly disinflationary, short-term movements are far less clear. While I have forecast a bounce back in price growth within some services categories, whether or not CPI inflation comes in at, above or below consensus estimates, is expected to largely depend on whether the material disinflation that was seen in core services prices in May, continues in June, and to what extent.

For further detail on my specific forecasts for some key CPI services components, see the “Breaking down the details” section below.

Ex-shelter measures expected to show that underlying inflation has broadly returned to target

On an ex-shelter basis (which helps to provide an insight into underlying inflation pressures as the CPI’s rent based measures are lagging), I expect headline CPI growth of 1.9% YoY, down from 2.1% in May. On a core CPI ex-shelter basis, I expect YoY growth of 1.8%, down from 1.9% in May. This would mark the slowest rate of growth seen since March 2021 and a rate of growth that is nearing the longer-run 2010-19 average of 1.4% YoY.

Given that the core CPI averaged YoY growth of 1.8% across 2010-19 and that the CPI tends to record a materially higher rate of growth than the PCE Price Index (see the below chart and discussion within my latest US Economic Summary and Outlook), the forecast rate of core CPI ex-shelter price growth would historically be broadly consistent with core PCE inflation of ~2% YoY.

Monthly core CPI inflation expected to mark a milestone that hasn’t been seen since February 2021

I expect the headline CPI to record a second consecutive month of broadly flat MoM growth in June (0.02% vs consensus: 0.1%), which would see 3-month annualised growth fall to just 1.4% (from 2.8%) and 6-month annualised growth fall to 3.0% (from 3.4%).

The core CPI is expected to record MoM growth of 0.12% (consensus: 0.2%). This would be the first time that monthly annualised growth came in below 2% for a second consecutive month since February 2021.

This would see 3-month annualised growth fall to 2.3% (its lowest level since March 2021) and 6-month annualised growth fall to 3.4% (its lowest level since December).

On an ex-shelter basis, headline CPI growth is expected to be MoM negative for a second consecutive month (-0.13%), taking 3-month annualised growth to -0.29% and 6-month annualised growth to 1.7%.

A second consecutive month of negative MoM growth is also expected for the core CPI ex-shelter (-0.01%), which would take 3-month annualised growth to just 0.70% (its lowest level since June 2020) and 6-month annualised growth to 2.0%.