US CPI Preview: May 2024

May's CPI report is not expected to show major disinflation, with services prices expected to drive elevated monthly core CPI growth. Nevertheless, the medium-term inflation outlook remains positive.

This US CPI Preview includes the following sections and subheadings:

Key YoY aggregates expected to remain largely unchanged from April

Core CPI measures expected to show no improvement in MoM growth

Implications for the Fed and markets

Breaking down the details

Durables prices expected to record further declines in May

Annual food price growth expected to moderate further in May, but the recent uptick in underlying food commodity prices could alter the CPI food price outlook

Gasoline prices expected to drive a material MoM decline in the CPI energy commodities index, but YoY growth is expected to rise

Apparel price growth has risen from its trough, but declining prices in a key input should provide further disinflationary support over the months to come

Rent based measures expected to see a further moderation of price growth

A host of other services related items are expected to record another month of elevated growth, but lower wage growth should support 2H24 disinflation

Key YoY aggregates expected to remain largely unchanged from April

In May, I forecast headline CPI growth of 3.40% YoY. While this is up slightly from the growth rate of 3.36% recorded in April, my forecast continues to round down to 3.4%, which is in-line with the consensus forecast for May.

I forecast core CPI growth of 3.57% YoY, down marginally from April’s growth rate of 3.61%. On a rounded basis, growth is expected to remain at 3.6% YoY, which is slightly above the consensus forecast of 3.5% — though at 3.57%, my forecast is not far away from rounding down to 3.5%.

Excluding the lagging shelter component, I forecast headline CPI growth of 2.33% YoY, up from 2.20% in April, and core CPI growth of 2.13% YoY versus 2.12% in April. Both of these growth rates remain well above the monthly average YoY growth rate of 1.4% recorded across 2010-19, highlighting that even when lagging shelter is excluded, the current pace of inflation remains notably above its historical average.

Core CPI measures expected to show no improvement in MoM growth

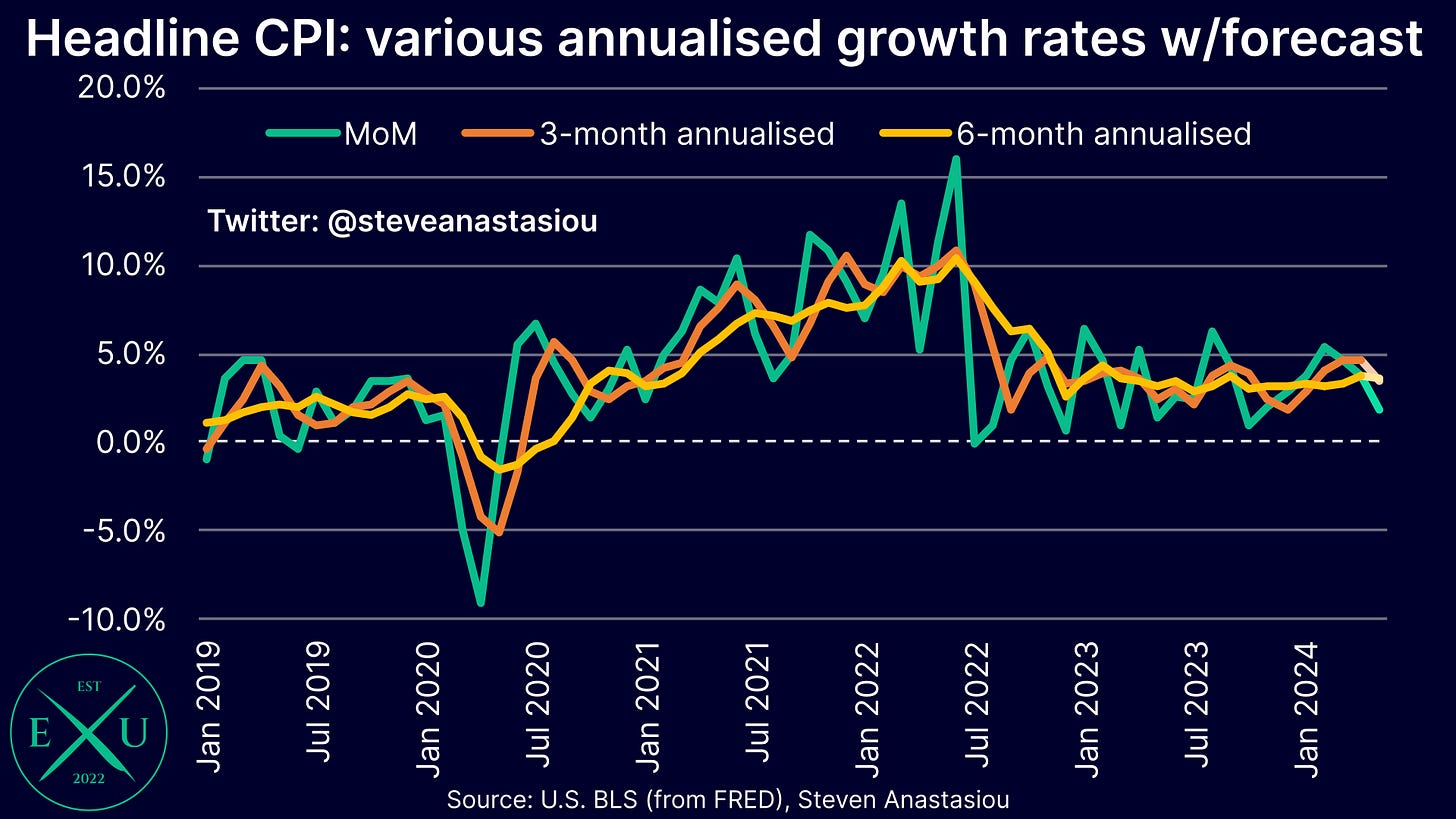

On a monthly basis, I expect headline CPI growth to moderate to 0.15% MoM, which would be the slowest pace of growth seen since October and compares to the consensus estimate of 0.1% MoM. MoM growth of 0.15% would result in 3-month annualised growth moderating to 3.4% and 6-month annualised growth remaining at 3.7%.