US CPI Review: April 2024

While bond yields plunged & equities rallied, US CPI growth (and core services prices in particular) remained elevated. The big retail sales miss may have instead been the key driver of asset markets.

Monthly inflation readings largely in-line with my estimates

US CPI growth was largely in-line with my estimates in April, with headline inflation falling to 3.36% YoY (versus my 3.39% forecast) and core inflation falling to 3.61% (versus my 3.67% forecast). Both measures were in-line with the consensus forecast to one decimal place.

On an ex-shelter basis, headline CPI growth fell to 2.2% (versus my 2.2% forecast) while core CPI growth fell to 2.1% (versus my 2.2% forecast).

While these ex-shelter measures (which strip out the CPI’s lagging rent based indices) may provide the impression that underlying inflation has largely normalised, it’s important to remember that each of these measures averaged YoY growth of 1.4% across 2010-19, indicating that underlying inflation pressures continue to remain significantly elevated.

Shorter-term trends remain far too hot for comfort

On a seasonally adjusted basis, MoM headline CPI growth came in at 0.31%, versus my 0.34% forecast and below the consensus forecast of 0.4% (consensus forecasts are given to one decimal place). While representing a second consecutive month of moderating growth, at 3.8% annualised, this remains far above the Fed’s 2% goal — though MoM growth has been impacted by three consecutive months of strong increases in the CPI energy commodities index, as a result of significant increases in gasoline prices.

3-month annualised growth remained at 4.6% YoY, while 6-month annualised growth rose to 3.7%, reaching its highest level since February 2023.

Core CPI growth came in at 0.29% MoM, versus my forecast of 0.34% and the consensus forecast of 0.3%. While this was a notable moderation from the prior three months (average MoM growth of 0.37%), at 3.6% annualised, it nevertheless remained significantly elevated.

While 3-month annualised growth moderated to 4.1% (from 4.5%), 6-month annualised growth rose to 4.0%, reaching its highest level since July.

Core CPI ex-shelter growth came in at 0.22% MoM versus my estimate of 0.25%. While also above the Fed’s target, the annualised growth rate of 2.7% is much more modest than the overall core CPI growth rate, indicating the significant impact of the CPI’s lagging rent based measures.

Despite the drop in MoM growth, 3-month annualised growth rose to 3.4% (from 3.3%), while 6-month annualised growth rose to 2.9% (from 2.7%), its highest level since May 2023.

All-in-all, both 3- and 6-month annualised trends continue to show that CPI growth remains materially elevated — even if shelter is excluded from the equation. This is in-line with the expectation outlined within my US CPI Preview, being that the Fed was unlikely to gain any significant additional confidence from April’s US CPI report.

Though as outlined in further detail within the “Breaking down the details” section of this report, one important positive is the continued moderation in the CPI’s rent based measures, which given their huge weighting within the CPI, is likely to provide the Fed with some increased confidence that inflation will moderate as the year progresses. This is something that I have been regularly articulating and providing in-depth updates on for subscribers — for further detail on the medium-term outlook for the CPI’s rent based measures, please see “Alternative BLS rental data points to major disinflation in CPI rents”.

Durables prices decline again, but services price growth remains significantly elevated

While I discuss the finer details in much greater depth within the “Breaking down the details” section of this report, as a broader high level overview, it’s important to highlight a continuation of the dichotomy between durables and services price growth.

Once again, durables prices saw a MoM decline, falling by 0.19% for the second consecutive month, while YoY growth plunged to -3.2% YoY — this is the largest decline that’s been seen since May 2004. This was driven by a material decline in used car prices and another significant fall in other durables prices (i.e. excluding new and used vehicles). This follows the expectation that I outlined within my latest medium-term US CPI forecast, where I noted my expectation that durables prices would see even larger declines during the remainder of 2024.

Though continuing to record significantly elevated price growth are supercore services prices (i.e. core services prices less the lagging shelter component), which is likely to significantly concern the Fed. Adjusting for inconsistently measured household operations and indirectly measured health insurance, supercore services price growth was 0.51% MoM or 6.3% annualised on a seasonally adjusted basis. This is well above the 2013-19 average of 0.17% MoM or 2.1% annualised.

While this was enough to see 3-month annualised growth dip to 6.9% (from 7.9%), 6-month annualised growth rose to 6.5% (from 6.2%), its highest level since September 2022.

Market reaction likely more related to the big miss in monthly retail sales

Given that CPI growth was largely in-line with consensus expectations and remained elevated, many would be wondering, why then was there such a significant market reaction, and one which indicated a loosening of monetary policy conditions?

To recap the market reaction, not only did the S&P 500 rise 1.2% and 10-year Treasury yields plunge from 4.45% to 4.34%, but gold prices rose 1.5% and silver prices rose by a very significant 3.6%.

Clearly, this combination of market moves is consistent with expectations for materially lower interest rates and materially increased liquidity, versus expectations in the day prior to the latest US CPI data.

Given the paradoxical nature of the latest inflation data (which remained materially elevated) and the market moves in response to it, I believe that the market moves are largely explained not by the latest CPI data, but instead by the huge miss on retail sales data, which was released alongside the US CPI report.

With consensus expectations for a 0.4% MoM increase in retail sales, growth came in flat. Furthermore, last month’s 0.7% increase was revised down to 0.6%.

While unpacking the data in some more depth shows that 3-month annualised growth strengthened significantly to 5.6% (as January’s large MoM decline rolled out of the equation), smoothing out some more of the monthly volatility shows that 6-month annualised growth remained lackluster, with growth of 1.5% recorded.

A 3-month moving average of retail sales growth on a YoY basis was stronger, with growth rising to 4.2%, from 3.4% in March. On this metric, growth bottomed in June and has generally strengthened since.

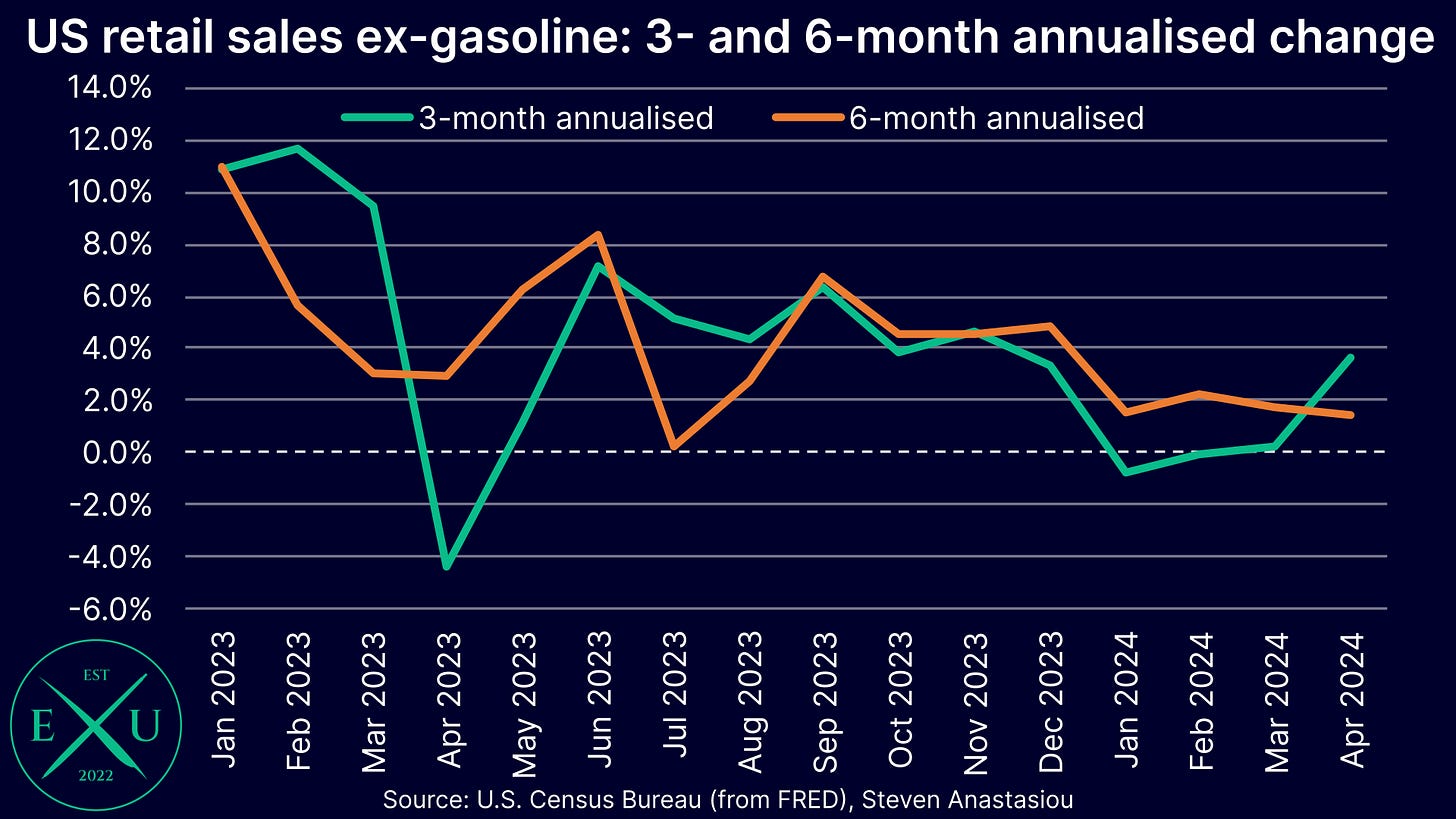

Given the volatility of gasoline prices and the nominal nature of retail sales data, I believe that a better underlying measure of retail sales growth involves looking at the data on an ex-gasoline basis.

On such a basis, MoM growth declined 0.24% MoM.

While the removal of January’s MoM drop from the 3-month annualised equation saw growth rise to 3.6%, 6-month annualised growth fell to just 1.4%, its lowest level since July.

A 3-month moving average of YoY growth rose to 4.3%, from 3.8% in March. Unlike for the headline retail sales index, this measure has not seen a strengthening trend over much of the past year.

Ultimately, with MoM growth (which the market often tends to focus on) coming in flat on a headline basis and negative on an ex-gasoline basis, this likely materially increased market concerns surrounding the outlook for US economic growth and the employment market, with flow-on expectations for Fed policy easing — particularly given that the CPI report did not deliver a significant negative surprise.

With the Fed already helping to boost asset prices via its significant reduction in QT (see: “Why the Fed's reduction in the pace of QT is critical for markets”), a further soft US economic data point likely helped to fuel expectations for further easing amongst many market participants.

The latest monthly retail sales data also reinforces the key points made in my prior analysis of the latest US GDP data, which included some views on my outlook for the remainder of 2024 (see: “US economic growth remained robust in Q1 and could accelerate in Q2 — but a very different story may emerge in 2H24”. In a nutshell, I articulated why favourable base effects are likely to support 2Q24 GDP growth, but that plunging savings rates are likely to pressure consumption and economic growth in 2H24, meaning that “the current backdrop points to a significant slowdown in 2H24”. Here’s an important excerpt from the research piece:

While 1Q24 GDP data was once again robust, and a favourable comparable points to a positive backdrop for 2Q24, it’s very important to note that the sustainability of this growth is becoming more questionable.

The key reason for this, is that continued relatively strong PCE [personal consumption expenditure] growth has not been driven by real disposable income, but by declining savings rates…. the savings rate declined to just 3.2% in March, its lowest level since October 2022 and well below the 2015-19 average of 6.2%. The last time that the savings rate declined to around these levels in 2022, it reached a trough and turned higher, suggesting that PCE growth may not benefit from significant further declines in savings rates over the remainder of 2024.

With leading indicators also suggesting that wage growth is likely to slow materially during the remainder of this year (see my latest Medium-Term US CPI Update for more detail), this suggests that PCE growth could slow materially in 2H24.

Given that real PCE growth is the key driver of growth in real GDP and real final sales to domestic purchasers, this therefore points to the potential for a broader economic slowdown in 2H24. Given that I also currently expect inflation pressures to materially subside in 2H24, this consumption outlook acts to further reinforce my current view, that multiple 2H24 rate cuts should not be ruled out just yet.

With retail sales growth flatlining in April and declining on an ex-gasoline basis, this reinforces my previously articulated concerns over the economic outlook, which when viewed in conjunction with the latest US jobs data (see: “Finely balanced"), further increases the potential for multiple rate cuts in 2H24.

While some portion of the above mentioned research reports can be viewed by all subscribers, to access the full reports, a premium subscription is required — as evidenced by the many link backs to previously released Economics Uncovered research reports, a premium subscription provides readers with a comprehensive, institutional grade overview of, and outlook for, the US economy, including an analysis of the potential implications for Fed policy and financial markets.

To fully benefit from your subscription to Economics Uncovered and to help support an independent, institutional grade, reader-supported publication, please consider becoming a premium subscriber.

To help improve the reach of this update, please consider liking this article by clicking the heart icon at the top of this post/email or by sharing it via the link below.