US CPI Review: July 2024

July's US CPI report revealed significant further disinflationary evidence, strengthening the case for a 50bp rate cut in September, in the event that the US jobs market weakens further in August.

In short …

Significant further disinflationary evidence was seen in July, with the latest CPI report highlighting a third consecutive month of major disinflation in adjusted core services prices. This additional disinflationary momentum is likely to clear the way for a 50bp rate cut to be delivered in September, in the event that upcoming employment data continues to a highlight a significant weakening in the US labour market.

While the ultimate outcome of the September FOMC meeting remains unclear — with lots of additional economic data still set to be delivered between now and 18 September — the latest inflation data and continued YoY declines in the real M2 money supply, suggest that the Fed should not be concerned about the potential for lower interest rates to lead to a near-term resurgence in inflation. Instead, the much greater risk is that a slow unwinding of the Fed’s significant interest rate hikes results in the US economy falling into a recession.

Key CPI aggregates highlight further disinflationary evidence

The headline CPI rose by 2.89% YoY in July, close to the Economics Uncovered estimate of 2.94% (consensus: 3.0%).

The core CPI rose 3.17% YoY in July, largely in-line with the Economics Uncovered estimate of 3.14% (consensus: 3.2%).

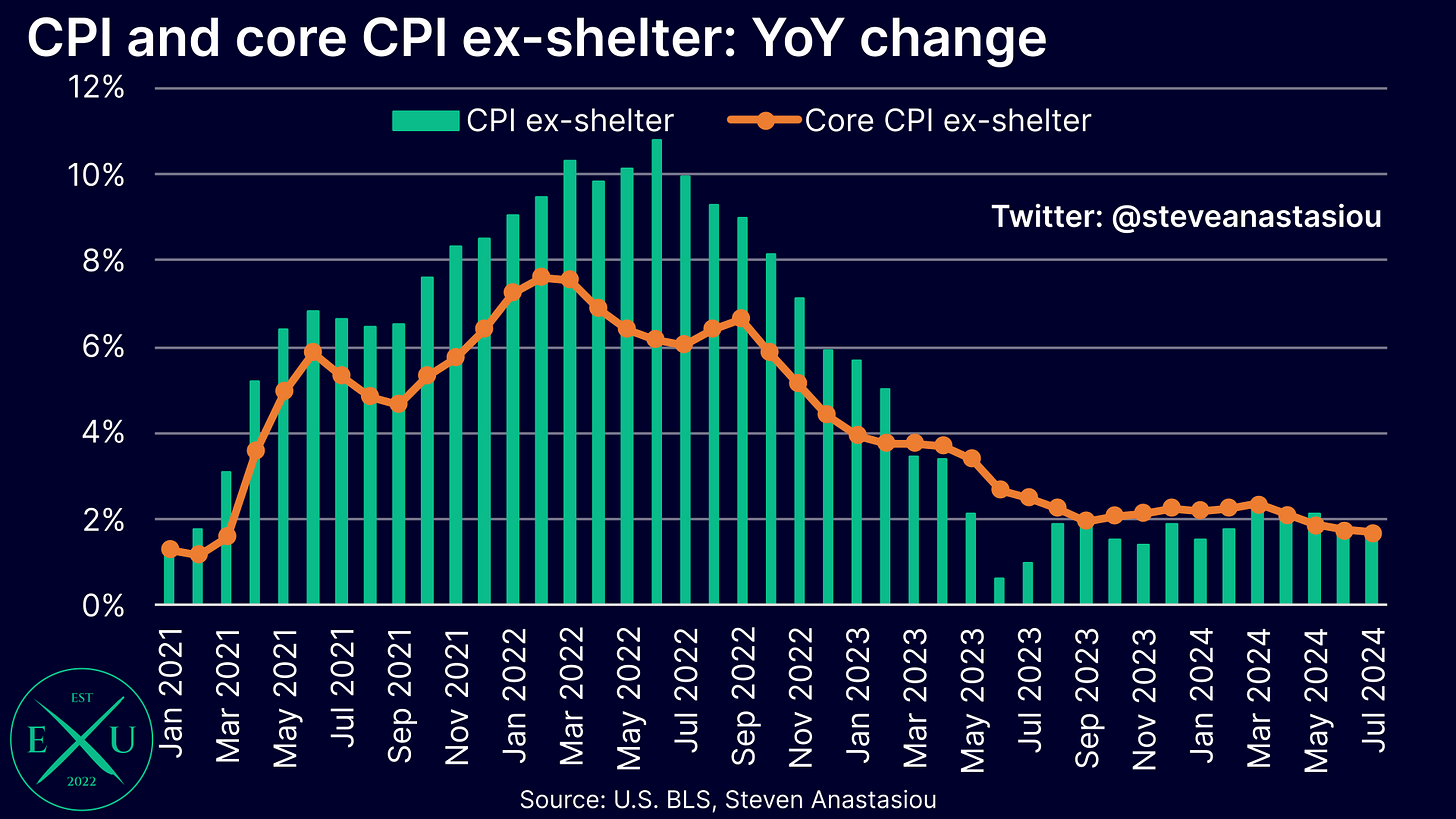

On an ex-shelter basis — which is important to analyse given the lagging nature of the CPI’s rent based measures — headline CPI growth fell to 1.7% YoY, from 1.8% (Economics Uncovered estimate: 1.8%).

Core CPI ex-shelter growth moderated for a fourth consecutive month, also falling to 1.7%, from 1.8% (Economics Uncovered estimate: 1.7%).

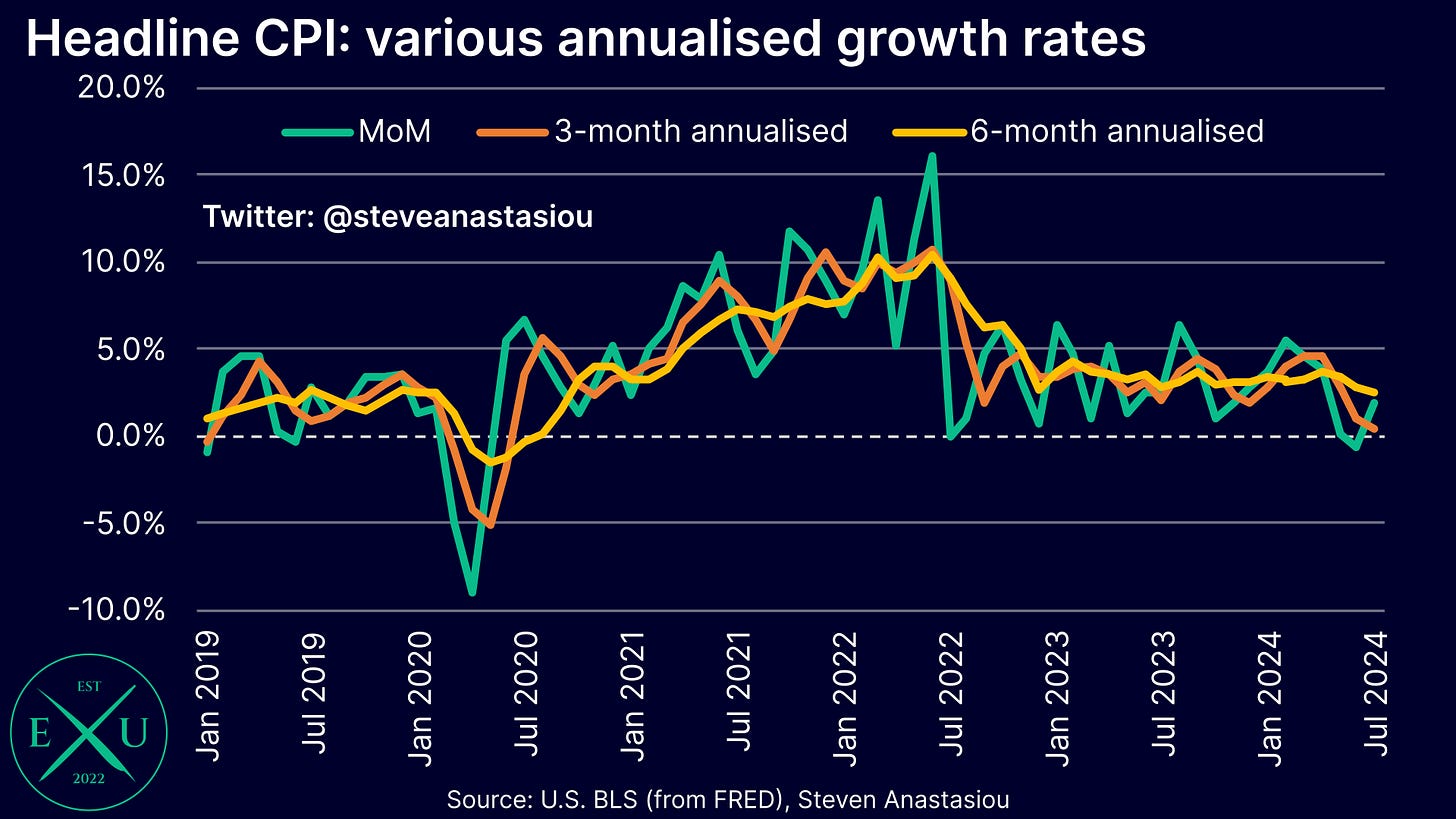

On a MoM basis, headline CPI growth rose by a seasonally adjusted 0.15% (Economics Uncovered estimate: 0.17%, consensus: 0.2%). This saw 3-month annualised growth fall to 0.42% (from 1.1%) to its lowest level since June 2020. 6-month annualised growth fell to 2.5% (from 2.8%), to its lowest level since September 2020.

Core CPI growth rose 0.17% (Economics Uncovered estimate: 0.09%, consensus 0.2%) MoM. This saw 3-month annualised growth fall to 1.6% (from 2.1%) to its lowest level since February 2021 and 6-month annualised growth fall to 2.8% (from 3.3%) to its lowest level since March 2021.

Headline CPI ex-shelter growth rose 0.03% MoM (Economics Uncovered estimate: 0.08%). This saw 3-month annualised growth fall to -1.5% (from -0.51%), which is the lowest level since June 2020. 6-month annualised growth fell to 1.4% (from 1.6%), to its lowest level since July 2023.

Core CPI ex-shelter growth rose -0.01% MoM (Economics Uncovered estimate: -0.09%), marking a third consecutive month of negative MoM growth. This saw 3-month annualised growth fall to -0.30% (from 0.64%), to its lowest level since June 2020. 6-month annualised growth fell to 1.5% (from 2.0%), to its lowest level since November.