The latest US jobs report is not as strong as it may seem

The stark divergence between the establishment survey and the household survey continued in May, with numerous factors suggesting that the jobs market is not in particularly strong shape.

While headline job growth surprised to the upside, which saw expectations for interest rate cuts wound back and Treasury yields move sharply higher, digging into the data continues to suggest that the US jobs market is not in a relatively strong position. When factoring into account my expectation for material 2H24 disinflation, I continue to expect at least two 2H24 interest rate cuts.

While focusing on headline nonfarm payroll growth suggests that the US jobs market remains strong, this is overlooking the fact that much of the apparent strength is likely to simply be a factor of higher immigration, with the household survey continuing to show that job growth is failing to keep pace with increases in the size of the labour force. Indeed, the household survey (which can provide a better view of the employment market around significant economic turning points than the establishment survey), is broadly painting a recessionary like picture.

Let’s dig into the detail.

Establishment survey data appears strong, but bear in mind the impact of increased immigration

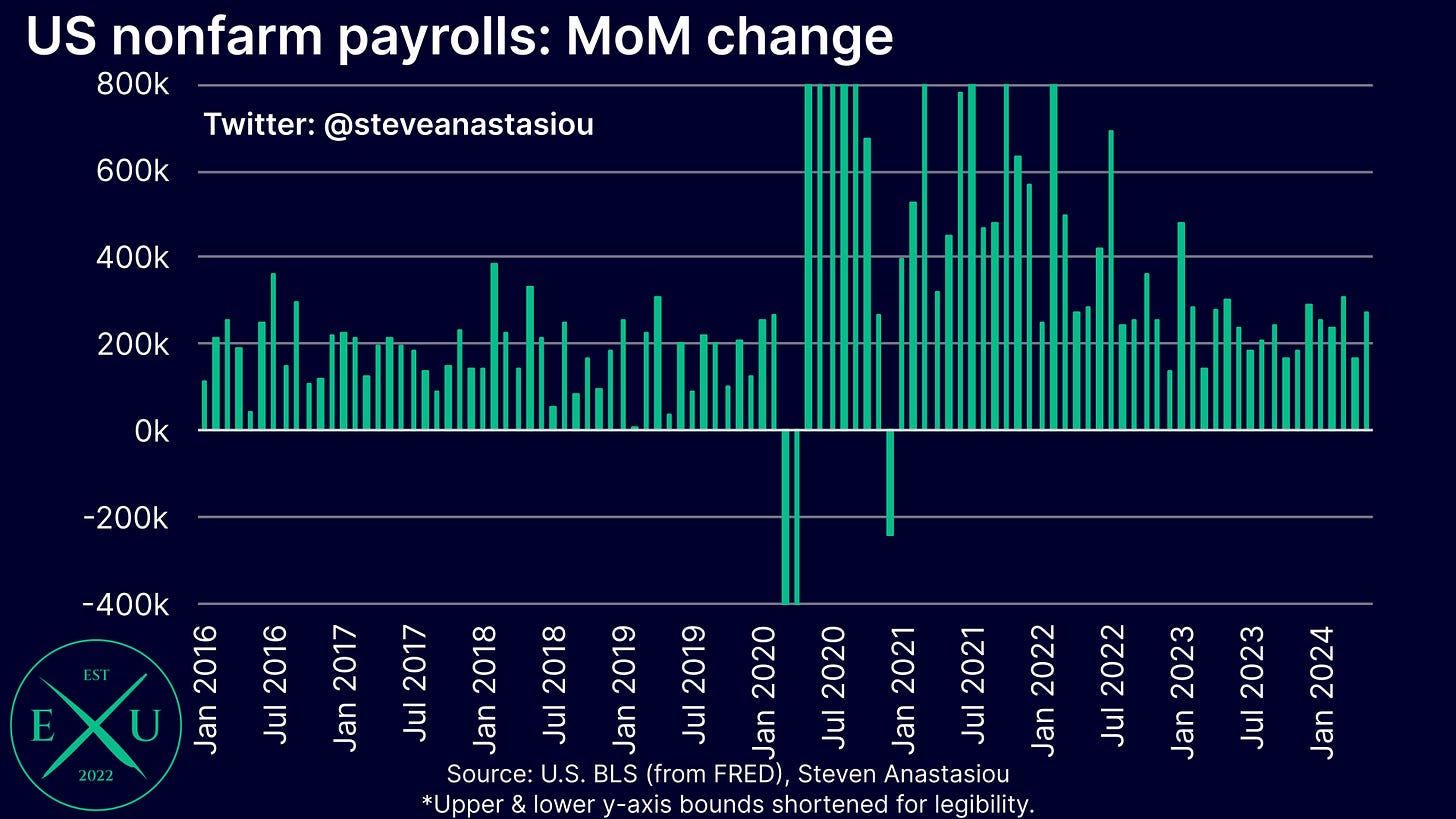

Nonfarm payroll growth, as measured by the establishment survey, increased by 272k jobs in May.

Alongside downward revisions of 15k to job growth in March and April, this resulted in 3-month moving average growth of 249k and 6-month moving average growth of 255k. This represents the fastest pace of 6-month moving average growth since June.

YoY growth remained at 1.8%. While this is a significant deceleration from the growth rate of 2.5% recorded a year ago, it remains notably above pre-COVID levels.

Focusing on the private sector component of nonfarm payrolls, MoM growth was 229k in May.

3-month annualised growth rose to 206k and 6-month annualised growth rose to 202k. Both of these metrics are at the highest levels that have been seen since June.

The uptick in private payroll growth in May aligns with a significant spike in the average response to the employment component of the various Fed branch surveys of the services sector in May.

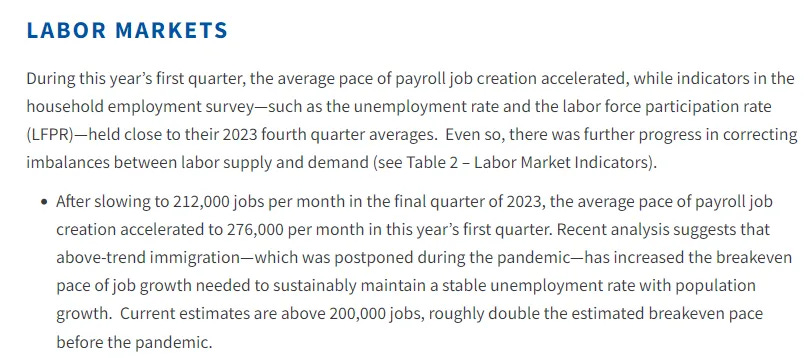

While the 3- and 6-month moving average growth rates for both overall nonfarm payrolls and private payrolls suggest that US job growth remains strong, it’s important to bear in mind that much of the apparent “strength” in US job creation is simply being driven by higher immigration levels.

The potential impetus from higher immigration could be responsible for over 100k additional jobs per months, meaning that the new monthly breakeven rate of employment growth is above 200k, versus historical norms of ~100k. This factor was highlighted by Eric Van Nostrand within the Economic Policy Statement that accompanied the Treasury’s most recent quarterly refunding announcement.

In light of this reality, US job growth is not as strong as historical norms would suggest. As discussed in the section below, the household survey is even showing that job growth is failing to keep pace with poplulation growth, leading to an unemployment rate that is trending higher.

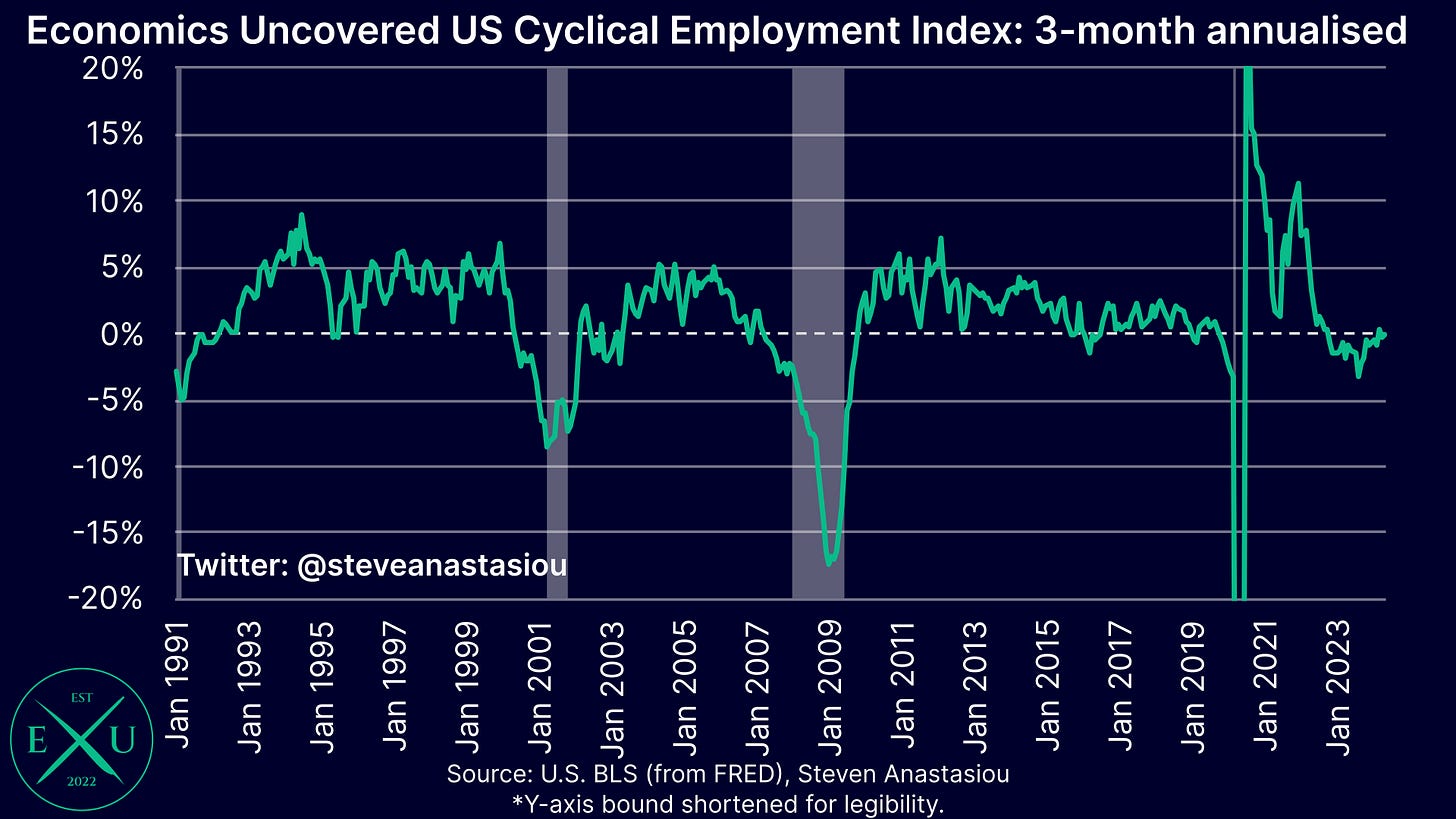

Providing a further indication of a sluggish employment market, is that cyclical employment growth continues to fall. The Economics Uncovered Cyclical Employment Index recorded MoM growth of -0.1% in May, with 3-month annualised growth also coming in at -0.1%. YoY growth fell to -1.1% in May.

While average hourly earnings growth moved higher in May, with MoM growth of 0.40% seeing the YoY growth rate rise to 4.1%, the longer-term trend indicates a gradual weakening in wage growth, which as discussed in the third section below, is being supported by alternative private sector measures of wage growth.