Why the Fed may cut rates by more than it currently expects

Key economic indicators suggest that the Fed may need to deliver more interest rate cuts than it currently expects, in order to keep the US economy in an expansionary state.

After much anticipation, the Fed delivered its first interest rate cut since March 2020, lowering rates by 50bps, which was in-line with my expectation (see: “Why the economic data supports a 50bp rate cut”).

The September FOMC meeting also brought a number of changes to the FOMC statement and material revisions to the Fed’s Summary of Economic Projections (SEP), with the Fed’s latest median federal funds rate projection now calling for 100bps of cumulative rate cuts in 2H24 (versus 25bps previously).

The Fed’s median projection is now in-line with the bottom end of the forecast that I had originally published on 5 August (see “Why the latest US jobs report points to a recession and what it means for the Fed and financial markets”), which was for 100-150bps of rate cuts in 2H24.

In my view, the key questions now are: 1) will the Fed deliver more than its current median projection of 50bps of additional rate cuts in the final two FOMC meetings of this year? and 2) will the Fed lower the federal funds rate below its current median year-end 2025 midpoint projection of 3.4%?

Before I provide an update to my current forecasts and attempt to answer these questions within the “Monetary policy implications and outlook” section below, let’s firstly unpack the key announcements that were made by the Fed and some key statements made by Fed Chair Powell at his latest FOMC press conference.

FOMC statement changes

SEP changes

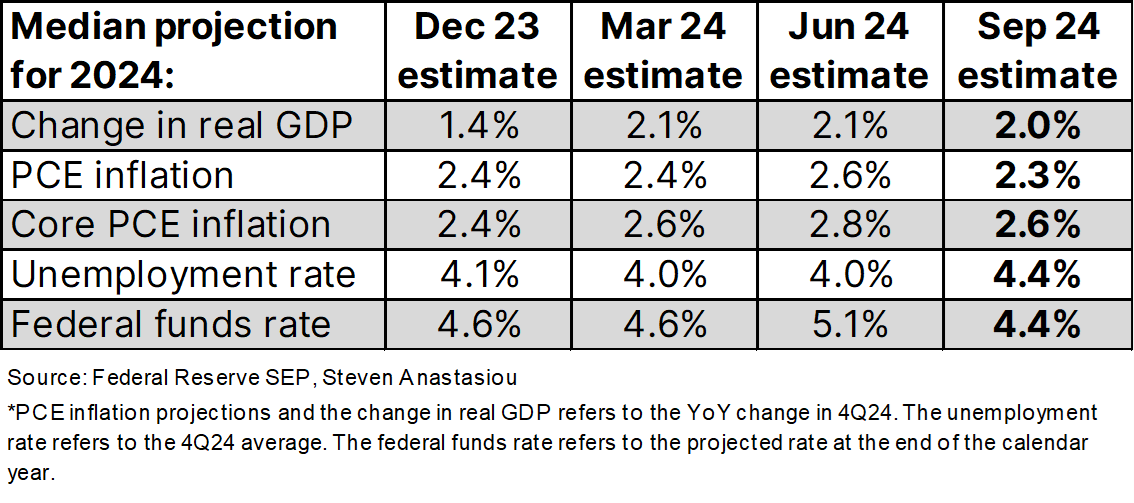

Reviewing the Fed’s latest SEP, material changes have been made to the median projections for interest rate cuts in both 2024 and 2025.

Looking firstly at the estimates for 2024, the latest SEP incorporates a year end federal funds rate of 4.4% (5.1% previously), which implies an additional 50bps of rate cuts by year end. With two FOMC meetings remaining within the year, this implies two 25bp rate cuts and cumulative 2H24 rate cuts of 100bps. This would see 2H24 rate cuts meet the bottom end of my expected range of 100-150bps, which I first outlined on 5 August within the “Monetary policy implications” section of this report.

The Fed’s median projection for the average unemployment rate in 4Q24 has been revised higher to 4.4% (from 4.0%) versus its current level of 4.2% and 3-month moving average of 4.2%. Given the weakening trends that have been seen in the US employment market and ongoing relative constraints in the growth rate of the M2 money supply, I believe that a further increase in the unemployment rate is the most probable outcome in 4Q24.

The Fed has also revised down its estimate for core PCE inflation to 2.6% YoY in 4Q24 (from 2.8%). I will have more to say about the likelihood of this being achieved upon releasing a future update to my medium-term US inflation estimates.

Looking ahead to 2025, the Fed has revised down its median estimates for inflation (reflecting its increased confidence in the inflation outlook) and revised its median unemployment rate projection higher — but only to 4.4% (from 4.2%), which is the same level that it expects the unemployment rate to average in 4Q24.

The median federal funds rate projection for the end of CY25 has been lowered significantly to 3.4% (from 4.1%), implying 100bps of additional interest rate cuts in 2025. Given that the Fed does not expect any further uptick in the unemployment rate and that it is continuing to forecast real GDP growth of 2.0% YoY in 4Q25, this implies that the Fed firmly expects a soft-landing, which is reflected in the fact that its CY25 federal funds rate projection of 3.4% remains above the median long-run interest rate projection (i.e. its neutral rate projection) of 2.9% (central tendency: 2.5%-3.5%). I discuss the probability of such a scenario playing out and my own expectations, within the “Monetary policy implications and outlook” section below.

Key statements from Fed Chair Powell’s Press Conference

Opening statement

“Today, the Federal Open Market Committee decided to reduce the degree of policy restraint by lowering our policy interest rate by 1/2 percentage point. This decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labour market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 percent.”

“In the labour market, conditions have continued to cool. Payroll job gains averaged 116 thousand per month over the past three months, a notable step down from the pace seen earlier in the year. The unemployment rate has moved up but remains low at 4.2 percent. Nominal wage growth has eased over the past year and the jobs-to-workers gap has narrowed. Overall, a broad set of indicators suggests that conditions in the labour market are now less tight than just before the pandemic in 2019. The labour market is not a source of elevated inflationary pressures.”

“As inflation has declined and the labour market has cooled, the upside risks to inflation have diminished and the downside risks to employment have increased. We now see the risks to achieving our employment and inflation goals as roughly in balance, and we are attentive to the risks to both sides of our dual mandate.”

“In light of the progress on inflation and the balance of risks, at today’s meeting the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point, to 4-3/4 percent to 5 percent. This recalibration of our policy stance will help maintain the strength of the economy and the labour market and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance. We are not on any preset course. We will continue to make our decisions meeting by meeting.”

“If the economy evolves as expected, the median participant projects that the appropriate level of the federal funds rate will be 4.4 percent at the end of this year and 3.4 percent at the end of 2025. These median projections are lower than in June, consistent with the projections for lower inflation and higher unemployment, as well as the changed balance of risks.”

“If the labour market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we are prepared to respond.”

Q&A

“Since the last meeting … we have had a lot of data come in, we’ve had the two employment reports … we’ve also had two inflation reports … we had the QCEW report which suggests that … the payroll report numbers that we’re getting may be artificially high and will be revised down … we’ve also seen anecdotal data like the beige book … we took all of those … and we concluded that this was the right thing for the economy, for the people that we serve and that’s how we made our decision.”

“I think we had a good discussion [on the size of a rate cut] … if you go back to Jackson Hole … I didn’t address the question of the size of the cut … and I think we left it open going into blackout and so there was a lot of discussion back and forth … I think there was also broad support for the decision that the committee voted on.”

“The labour market is actually in solid condition and our intention with our policy move today is to keep it there.”

“I do not think that anyone should look at this and say “Oh this is the new pace” … you have to think about it in terms of the base case … in the base case … look at the SEP … we’re recalibrating policy down over time to a more neutral level and we’re moving at the pace that we think is appropriate given developments in the economy in the base case.”

“Reserves have really been stable, they haven’t come down so reserves are still abundant and expected to remain so for some time. As you know, the shrinkage in our balance sheet has really come out of the overnight RRP, so I think what that tells you is we’re not thinking about stopping runoff because of this [rate cut] at all. We know that these two things can happen side by side, in a sense they’re both a form of normalisation and so for a time you can have the balance sheet shrinking but also be cutting rates.”

“Labour market conditions have cooled off by any measure … but they’re still … actually pretty close to what I would call maximum employment … so you’re close to mandate, maybe at mandate … clearly payroll job creation has moved down over the last few months and this bears watching …. by many other measures the labour market has returned to, or below 2019 levels, which was a very good, strong labour market but this is more sort of 2018, 17 … so the labour market bears close watching and we’ll be giving it that, but ultimately we think … with an appropriate recalibration of our policy that we can continue to see the economy growing and that will support the labour market.”

“Retail sales data that we just got, second quarter GDP, all of this indicates an economy that is still growing at a solid pace, so that should also support the labour market over time.”

"We’re not seeing rising claims, we’re not seeing rising layoffs, we’re not seeing that and we’re not hearing that from companies that that’s something that’s getting ready to happen. So we’re not waiting for that because … there is thinking that the time to support the labour market is when it’s strong and not when you begin to see the layoffs”

“We have a dual mandate … we’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment … and I think you can take today’s action as a sign of our strong commitment to achieve that goal.”

“The downside risks to employment have increased and because we have been patient and held our fire on cutting while inflation has come down, I think we’re now in a very good position to manage the risks to both of our goals".

“It’s always a question of look at the incoming data and ask, what are the implications of that data for the evolving outlook and the balance of risks, and then go through our process and think what’s the right thing to do? Is policy where we want it to be, to foster the achievement of our goals over time?”

“On the job creation, it depends on the inflows … so if you’re having millions of people come into the labour force … and you’re creating 100,000 jobs, you’re going to see unemployment go up, so really it depends on what’s the trend …. of people coming into the country.”

“Certainly it appears that we’ve very close to that point, if not at it … [where] further declines in job openings will translate more directly into unemployment.”

“Many people … would say we’re probably not going back to that era where there were trillions of dollars of sovereign bonds trading at negative rates … and it looked like the neutral rate might even be negative … my own sense is that we’re not going back to that, but you know, honestly we’re going to find out, but you know it feels to me that the neutral rate is probably significantly higher than it was back then. How high is it? I just don’t think we know. Again, we only know it by its works.”

“The US economy is in a good place and our decision today is designed to keep it there. More specifically, the economy is growing at a solid pace, inflation is coming down closer to our 2% objective over time and the labour market is still in solid shape, so our intention is really to maintain the strength that we currently see … and we’ll do that by returning rates from their high level … to a more normal level over time.”

“No we’re not [declaring a decisive victory over inflation] … the goal is to have inflation move down to 2% on a sustainable basis … we’re close but we’re not really at 2% and I think we’re going to want to see it be … around 2% and close to 2% for some time … we’re not saying mission accomplished or anything like that, but I have to say though, we’re encouraged by the progress that we have made.”

“Housing inflation is the one piece that is kind of dragging a bit … we know that market rents are doing what we would want them to do, which is to be moving up at relatively low levels, but … the leases that are rolling over are not coming down as much and OER is coming in high … it’s been slower than we expected. I think we now understand that it’s going to take some time for those lower market rents to get into this, but you know the direction of travel is clear and as long as market rents remain … relatively low … over time that will show up … I don’t think the outcome is in doubt, again, as long as market rents remain under control … the rest of the elements that go into core PCE inflation have behaved pretty well … we will get down to 2% inflation, I believe, and I believe that ultimately we’ll get what we need to get out of the housing services piece too.”

“The US economy is basically fine if you talk to … business people, who are actually out there doing business. So I think our move is timely. I do and as I said, you can see our 50bp move as a commitment to make sure that we don’t fall behind.”

“If we had gotten the July [jobs] report before the [last] meeting would we have cut? We might well of.”

“We can’t look a year ahead and know what the economy is going to be doing.”

“We will continue to look at that broad array of labour market data, including the payroll numbers … but we will mentally tend to adjust them [downward] based on the QCEW adjustment.”

“We’re recalibrating our policy over time to a stance that will be more neutral and today … I think we made a good strong start on that. I think it was the right decision and I think it should send a signal that we’re committed to coming up with a good outcome here.”

“I don’t see anything in the economy right now that suggests that the likelihood of a recession, sorry, of a downturn, is elevated.”